They got away with stealing half a trillion four years ago. Not a surprise.

politics

Welcome to the discussion of US Politics!

Rules:

- Post only links to articles, Title must fairly describe link contents. If your title differs from the site’s, it should only be to add context or be more descriptive. Do not post entire articles in the body or in the comments.

Links must be to the original source, not an aggregator like Google Amp, MSN, or Yahoo.

Example:

- Articles must be relevant to politics. Links must be to quality and original content. Articles should be worth reading. Clickbait, stub articles, and rehosted or stolen content are not allowed. Check your source for Reliability and Bias here.

- Be civil, No violations of TOS. It’s OK to say the subject of an article is behaving like a (pejorative, pejorative). It’s NOT OK to say another USER is (pejorative). Strong language is fine, just not directed at other members. Engage in good-faith and with respect! This includes accusing another user of being a bot or paid actor. Trolling is uncivil and is grounds for removal and/or a community ban.

- No memes, trolling, or low-effort comments. Reposts, misinformation, off-topic, trolling, or offensive. Similarly, if you see posts along these lines, do not engage. Report them, block them, and live a happier life than they do. We see too many slapfights that boil down to "Mom! He's bugging me!" and "I'm not touching you!" Going forward, slapfights will result in removed comments and temp bans to cool off.

- Vote based on comment quality, not agreement. This community aims to foster discussion; please reward people for putting effort into articulating their viewpoint, even if you disagree with it.

- No hate speech, slurs, celebrating death, advocating violence, or abusive language. This will result in a ban. Usernames containing racist, or inappropriate slurs will be banned without warning

We ask that the users report any comment or post that violate the rules, to use critical thinking when reading, posting or commenting. Users that post off-topic spam, advocate violence, have multiple comments or posts removed, weaponize reports or violate the code of conduct will be banned.

All posts and comments will be reviewed on a case-by-case basis. This means that some content that violates the rules may be allowed, while other content that does not violate the rules may be removed. The moderators retain the right to remove any content and ban users.

That's all the rules!

Civic Links

• Congressional Awards Program

• Library of Congress Legislative Resources

• U.S. House of Representatives

Partnered Communities:

• News

Wait half a trillion? When did that happen?

COVID was the most transparent upwards transfer of wealth I've ever seen in my lifetime.

Nobody noticed it at all, but it happened.

To get us out of the COVID market crash (which should've been allowed to happen in a "free market") we got a Fed that was actively buying financial products to keep the market from imploding.

Yeah, they do this regularly (see also 2008 for example). The devaluation/inflation of currency is a crucial tool for transferring wealth from the poor to the rich. That's one of the fundamental reasons why crypto was developed.

During the COVID "response". About half a trillion went out with oversight sabotaged, while the federal government engaged in literal acts of piracy to enrich the Trump family. All with no consequences.

Ah, so that's why bitcoin spiked out of nowhere. All the grifters passed around some inside information and stocked up before this went public.

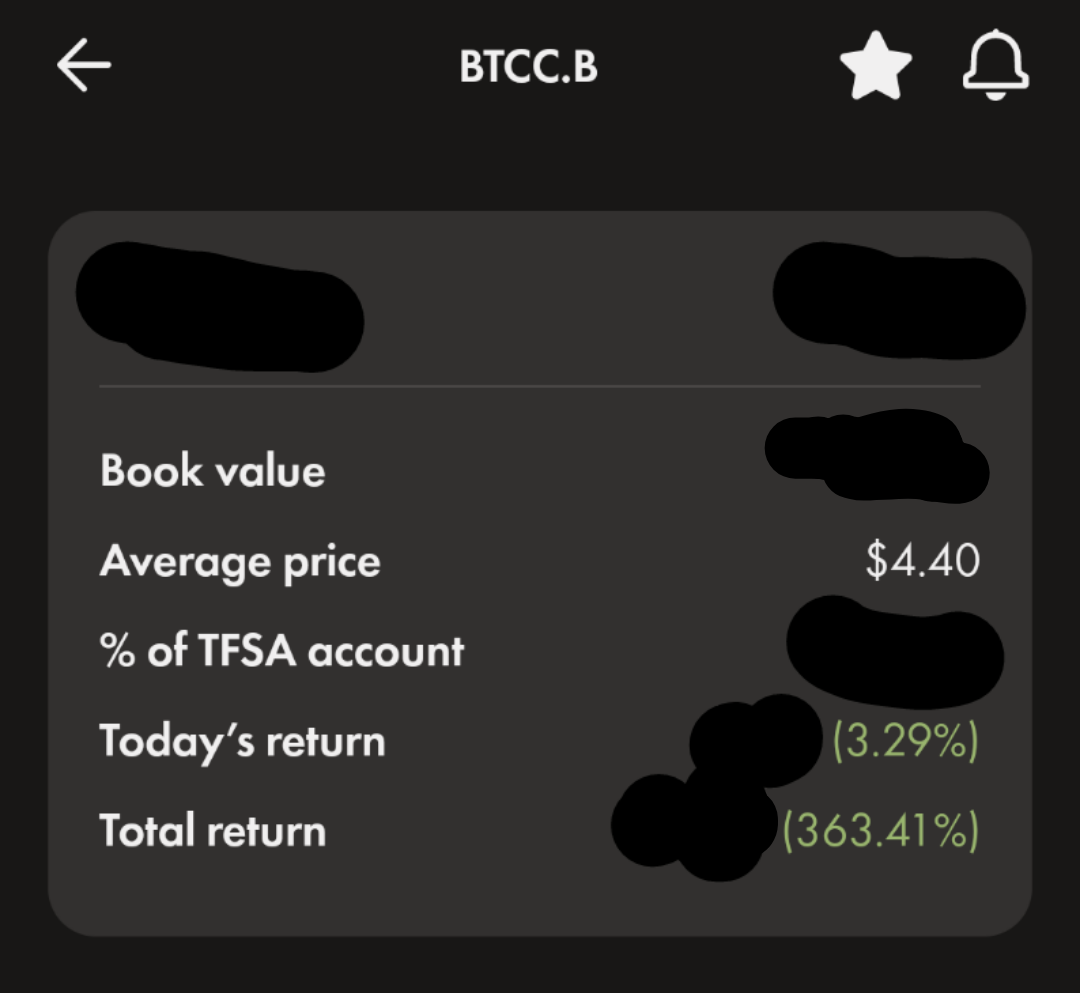

I have a very small investment in a btc etf but have watched it go up 150% in the past 2 weeks.

Btc is an instrument to end the central banking system and bypass sanctions.

A while back I decided I'd put my money where I knew the evil people were heading.

Turns out my (very small) portfolio has gone up 56% the past month.

Crime pays, I guess is the lesson.

(Purchased last year at 4.40 a share)

Btc is an instrument to end the central banking system and bypass sanctions.

...He says, smugly holding his BTC in a centrally banked backed ETF

Not your keys, not your coins.

No it spiked due to tether printing money. As always

Hey, constituents! Ever wanted to find out the breaking point of society through inequality?

If we want to have some sort of strategic crypto reserve, or some crypto dollar currency, why the Hell would we buy Bitcoin to do it? We can just whip up our own coin. Flat out call it CryptoDollars if you want. IDK. The federal government can create a coin, give it out to people for free, and then in turn accept it for taxes, the same way any currency is backed. Buying up existing market Bitcoin is just idiotic.

Because it's not tied to whatever shitcoin Trump and Musk are trying to pump and dump

I think it is rather clear. This is not about having a crypto reserve but about increasing the value of musks' Bitcoin wallet.

Because paper money can be instantly created by any bank/etc in the form of a loan/etc.

That would be extremely difficult with any crypto of value since it would be constantly devalued (like the USD) but probably transparently for the any foolish "investor" to see.

😆 what a fucking grift.

"Conservative" populism is the grift that keeps on giving

If you have a billion dollars worth of Bitcoin but you can't sell it for a billion dollars, then you really don't have a billion dollars worth of Bitcoin.

Yup, and it only takes one whale trying to cash out too much to cause a run on the market.

One whale isn't going to be able to cause a run on a $2T market cap.

Bitcoin has absorbed the liquidation of the remaining assets from an entire defunct exchange before.

Market cap isn't liquidity. There's only a few billion dollars of Bitcoin on offer at any given point so dumping another few billion into the market all at once would cause an enormous swing in price. The market may absorb it quickly enough for the price to recover, but it could also trigger panic selling which lowers the price further, which causes more panic selling... and voila there's your run. It wouldn't destroy Bitcoin, but the price could take a very long time to recover if it does at all.

Agreed. I've been hearing that Bitcoin is going to all come crashing down for at least 14 years, possibly 15. I suppose it still could happen - but.

would literally be funding terrorists, terrorist states, organized crime, state sponsored hacking groups, weapons dealers, drug cartels......

Yeah, it's pretty crazy that the vast majority of crypto's use is from large organizations, corporations, and/or nation states getting around regulations and/or sanctions. Not at all surprising, just crazy.

donvict and some of his comrades have crypto holdings. a lot of crypto. they're gonna pump and pump and pump.... and won't give a shit about consequences.

It's even crazier that genocidal empires have violently controlled the global money supply for so long with paper.

You mean like literal bags of cash have been for centuries?

Most crimes are dollar-denominated and other currencies also vastly outweigh crypto in criminal use.

Bitcoin is highly traceable, with all transactions recorded and publically avaliable for review at the press of a button. Can't say that about regular money

You know, being a currency....

if you want to take leverage away from the federal reserve..

The only thing worse than big corporations owning the government is big corporations and con artists sharing ownership in the government.

North Korea has stolen many billions of dollars in Bitcoin in the last 5 years due to targeting hacking efforts. However, they struggle to spend it or launder it because nobody will be the ones left holding stolen NK Bitcoin.

If we make Bitcoin strong and fungible, we empower North Korea more than anyone else. It's a bad idea.

Also, Russia used it to get around sanctions. Go figure.

The distant roar of pump memes can be heard across the nation.

Coincidentally, it is rumored that Satoshi holds a little over a million Bitcoin that has never moved, from the project's early days when it was worth a fraction of a cent and he was the only one mining it, earning 50 worthless BTC every 10 minutes. It's been widely assumed that those early Bitcoin wallets are lost. But what if they're not? Someone is sitting on billions of dollars, but can't sell, because that valuation is based, in part, on those particular assets being lost.

The article is right that this is all about banking out the largest BTC investors, because they can't just go to the markets and dump thousands of BTC at once. But they can sell that BTC directly to the Government, bypassing the markets entirely. The same government who can keep the BTC on the balance sheet, and print dollars in exchange. Just like Tether does, only legally this time. And if Satoshi (or his heirs) still have access to that early BTC, the Government is perhaps the only entity they can sell it to that won't cause a massive panic the minute those coins are moved on the blockchain.

But the article notes that Bitcoin was born out of a distrust of central banking and the Government in general. If this is the plan, I am sure that Satoshi is spinning in Hal Finney's grave over it.

Here's the thing ... if there aren't buyers enough to maintain the price, the paper value isn't correct. This is an artifical scarcity, and this bill would be a bail out to the rich and leave the US taxpayers holding the bag when the market crashes. The US taxpayers would then own all this bitcoin with no way to sell without crashing the market so it's just a direct transfer of wealth to the current holders.

Bitcoin does have artificial scarcity, though. There can only ever be 21 million in existence under the current protocol. Nearly 20 million have been released through mining, so there are only a little over 1 million left to mine. (There's that number again....)

Yes, Bitcoin is an open-source project and anyone can modify the code, but the network operates based on all the mining nodes accepting the same rules. If I were to run a node that changes the rules to mine more BTC out of thin air than the protocol allows, other nodes would just reject it. Changing the 21 million limit would involve getting all these miners to decide to change that code, and why would they do that, when it would dilute the coins they have already mined?

I agree with you, though, that it is too risky for the US Government to keep BTC in reserve. It's price widely fluctuates, it has reached $100k but is probably going to be valued at less then $50k at some point in Trump's term. It will also be valued at more than $200k at some point during Trump's term. Speculators are betting on which will come first. The US Government shouldn't be involved at all.

the paper value isn’t correct.

There is no such thing as a "correct" value. That's just market ideology - believing that there's some "objective" price that will eventually prevail.

If everybody sold their stock in any company at the same time, the market would collapse. The price at exchanges just represent how much people are willing to buy/sell at the current time. This is constantly changing based on endless, objective and subjective factors.

Someone is sitting on billions of dollars, but can’t sell, because that valuation is based, in part, on those particular assets being lost.

Ok if someone tried to sell hundreds of billions at once. But somebody could sell maybe a million here and there over a long period of time. That hasn't happened in the case of these "Satoshi" bitcoins.

The Satoshi coins are special, because even though they exist and are part of the calculated BTC "market cap", everyone assumes the keys are lost and factors that into the scarcity price. So if those coins move for any reason it proves that someone still has the keys, then at best the market takes an immediate 5% haircut to account for the increased supply. But since so much of the story around Bitcoin is about it's mysterious anonymous creator, it could cause more of a dump as people think that if Satoshi is bailing on the project, it is probably over for good.

But if those coins go to a wallet publically associated with the US Government, with a pledge to hold on to them as a reserve, that sends a different statement, that those coins are controlled but can still be counted on not to move....

.... as long as Government policy doesn't change. So now Democrats come to a reckoning on crypto. Because if Bitcoin becomes Officially Endorsed by the US Government, all the Crypto Bros now have even more reason to sell 100 of their BTC every four years to put their thumb on the election. And if Democrats take over and put the screws to Crypto causing a meltdown, it now puts a big hole in the US balance sheet.

Yeah, this is ALL about the grifting.

The rubes voted for donvict hoping he'll "hurt the right people" and he may. But the REAL fucking goal is to make the broligarchs even more fucking money and the rubes - they'll get fucked as much as anyone.

Well at least I have something to look forward to as the world goes down in flames...

Just wait until the ~~Divorced Fascist Trenchcoat Buddy Association~~ department of government "efficiency" hears about this...

The Department of Government Efficiency whole supports this fiscal misadventure.

I drove past a really sketchy Circle K earlier today that had a Bitcoin ATM sign. Looked like the sort of place where someone would stick a gun to the back of your head and force you to make a large cash withdrawal.

Thats an odd way of saying the government will buy and hold crypto, theyve stolen as much from bitoin pioneers like Ross Ulbricht, about time they start actually paying for it.

It’s definitely a flash point issue, but I do see some merits to this:

Over it’s 15 years in existence, it’s a fact that one Bitcoin has gone from pennies per Bitcoin to over $100,000 per Bitcoin. That’s a 60% ARR, the highest asset return in history. Despite it’s often negative connotation, it makes perfect sense to adopt and hold as a digital asset - the supply is fixed and can never be increased (no debasement), scarcity is built in (halving), the price is the price (no discounts, coupons, or special rules for the ultra wealthy, governments, or other special interests), and it’s agnostic (no risk if any particular gov’t falls, etc). It will only continue to increase in value, as ETFs are now a sanctioned and regulated investment in the US and other places. With sovereign nations beginning to openly discuss its inclusion into portfolios, it feels like worldwide perception is beginning to shift toward use a legal asset at a minimum and a worldwide reserve currency at a maximum.

It’s a “get-in-while-you-can” play, pure and simple. The US should definitely hold onto what it already currently has (~200,000 Bitcoin) as a reserve at a minimum.