The credit scores aren't even government scores, just private companies that decided to collect everyone's information and the government won't do anything about it 'because of the economy'.

Lemmy Shitpost

Welcome to Lemmy Shitpost. Here you can shitpost to your hearts content.

Anything and everything goes. Memes, Jokes, Vents and Banter. Though we still have to comply with lemmy.world instance rules. So behave!

Rules:

1. Be Respectful

Refrain from using harmful language pertaining to a protected characteristic: e.g. race, gender, sexuality, disability or religion.

Refrain from being argumentative when responding or commenting to posts/replies. Personal attacks are not welcome here.

...

2. No Illegal Content

Content that violates the law. Any post/comment found to be in breach of common law will be removed and given to the authorities if required.

That means:

-No promoting violence/threats against any individuals

-No CSA content or Revenge Porn

-No sharing private/personal information (Doxxing)

...

3. No Spam

Posting the same post, no matter the intent is against the rules.

-If you have posted content, please refrain from re-posting said content within this community.

-Do not spam posts with intent to harass, annoy, bully, advertise, scam or harm this community.

-No posting Scams/Advertisements/Phishing Links/IP Grabbers

-No Bots, Bots will be banned from the community.

...

4. No Porn/Explicit

Content

-Do not post explicit content. Lemmy.World is not the instance for NSFW content.

-Do not post Gore or Shock Content.

...

5. No Enciting Harassment,

Brigading, Doxxing or Witch Hunts

-Do not Brigade other Communities

-No calls to action against other communities/users within Lemmy or outside of Lemmy.

-No Witch Hunts against users/communities.

-No content that harasses members within or outside of the community.

...

6. NSFW should be behind NSFW tags.

-Content that is NSFW should be behind NSFW tags.

-Content that might be distressing should be kept behind NSFW tags.

...

If you see content that is a breach of the rules, please flag and report the comment and a moderator will take action where they can.

Also check out:

Partnered Communities:

1.Memes

10.LinuxMemes (Linux themed memes)

Reach out to

All communities included on the sidebar are to be made in compliance with the instance rules. Striker

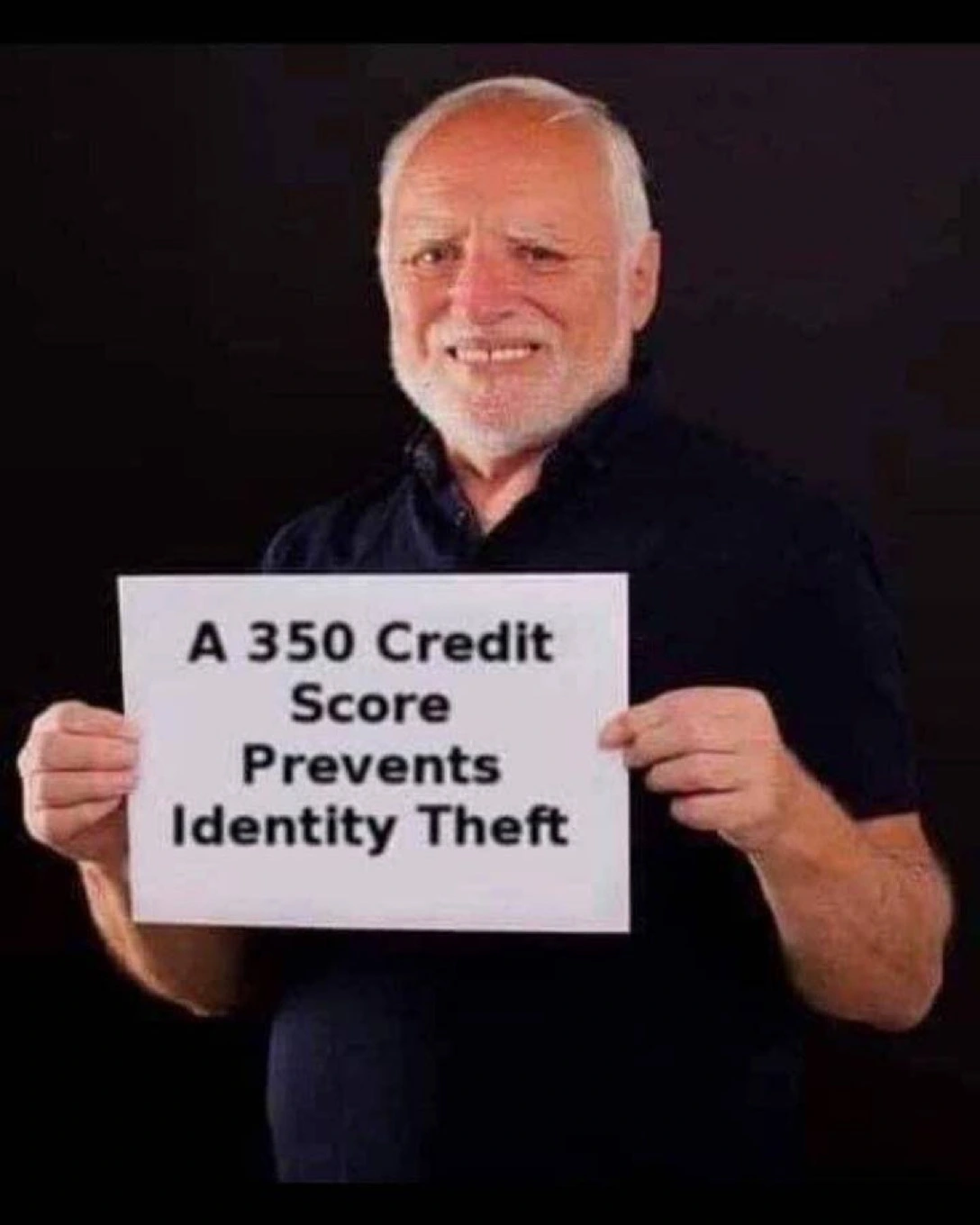

It also prevents credit cards

That’s the joke

What if someone is starting off getting their first credit card as a teen? Wouldn't the credit score be zero?

There's a difference between bad credit and no credit. Some places refuse both, but you can find places that will deal with no credit.

Basically, but they call it a thin file (aka no credit history). If you don't have someone to cosign, they'll start you off with a secure card, where you pony up a couple hundred bucks and borrow against yourself until you establish good history.

Discover Student will typically give you an unsecured line for your first card.

No teenager should be given a credit card under any circumstances. That's a great way to find yourself bankrupt.

Edit: Guys are we talking about credit cards or debit cards? There's a significant difference between the two and there's a lot of people telling me they had credit cards as teenagers, which seems unthinkable to me.

Not when teens have access to finance 101 classes in high school. It was an elective in my HS and you better believe I took it. I learned how to do my taxes, balance a budget. It was great. I wish this was a hard requirement for all HS students.

But I will agree, teenagers are pretty stupid. but at least I was a knowledgeable stupid teenager.

In my case, it was with the bank I already had a checking account with and the credit limit was like $500. They normally start you off with a super low limit and a high interest rate.

The government doesn't want you to know this, but identities are free. You can just take them. I have 458 identities.

Americans getting credit cards so young is so foreign to me. Here you only get a credit card either for business reasons or if you travel internationally where the European standards for debit cards don't apply

I was advised by my family, and the bank when I was 16 to get a Credit Card so I could build my credit score. I didn't really have any good financial awareness and they set me at a $2000 limit. Needless to say that was maxed almost immediately and took years of developing discipline to get under control. I still struggle with CCs now and then... They're too easy to come by and too hard to break free of

Where I'm from almost no one under 25 gets a credit card, because most non-online/prepaid/crypto credit cards have an age or income limit.

Everyone over the age of 12 has a debit card here. I think it promotes healthy spending knowing you have a set limit and immediately see the amount of money change. Overdrafts are also not enabled by default and require an extra package.

Venmo/Cashapp etc are also uncommon here.

Credit cards have much better fraud protection then debit

The fraud prevention page for my mastercard debit card is the same page as the credit card page.

However, what I really recommend is you can get travel cards that you load with minimal money and are entirely disposable. You don't need to only use them overseas. I have used them for online payments and in person payments and they're disposable. That is I can get two more unique cards with unique numbers at any time. Minimising my personal risk since they can't be used as ID and I limit the money on the card to just what's needed. If it's stolen skimmed or tried to be used fraudulently I might at most lose 50 dollars but I also probably know who within a margin of error skimmed it since I rotate them with new cards every so often.

I'm also in a place where losing 50 Australian dollars won't financially bankrupt me if it was stolen. Because I'm pretty sure there is lots less fraud protection on those travel cards.

Anyway there's alternatives for those who can't or morally object to credit cards. Like me. Mine is I'm bad with money, I morally don't trust myself since I went into 10k debt at 18.

If there's fraud on a credit card, the bank fights to get their money back. If it's fraud on a debit card, you fight for your money. Also if there's fraud on your debit, that's money out of your bank account that immediately affects you. With credit, it doesn't at all. Debit has much weaker liability then credit, and also a time limit where you just lose all money if it's not reported right away, with no limit to how much you can lose if you don't get it back in time (usually 60 days). That trust that you won't go in debt with credit cards is essentially why the credit system exists, to measure that. There's nothing that has to do with morals, it's just a payment method.

I got a credit card as a teen and have always just treated it like cash. Zero issues doing that and it helped build up my credit score by giving me such a long credit history with good payments.

As an European credit scores sound so weird to me 😮

They're basically a black box and can do some really weird shit (I had mine drop by 80 points, which is a lot, all because I paid off my student loans), but their purpose and basic workings are pretty straightforward. You show that you can be trusted when you're given a loan and can pay it back? Score go up. Do things that make the bank question if you can pay them back? Score go down.

Now, there's a shitton of complexity to it I won't go into, but it's not always as bad as people make it out to be and really only matters when you're trying to get a loan and sometimes when you're renting somewhere.

That I understand, but adding your kids on your credit card so their score goes up and things like having debt just to pay it back is weird to me

Probably the best advice I've gotten was "it may be a loan and someone else's money but you best treat it as your own money because it will eventually be your money and you have to pay for everything"

I kinda doubt the thieves are very picky.

350 is basically "don't loan this dork money under any circumstance."

You have to work to get a 350. I've been selling cars a long time and seen only a couple go that low. We always say on scores like that we couldn't get financed on a dollar with 4 quarters down.

Scorched earth credit score strategy

I truly feel credit cards are a tax on the poor.

Sure you can try to keep up on payments, one day you may find out you cannot.

I can confirm this is false.

You can somehow still get $4k limit cards with absolute dog ahit credit.

On the other side if you don't find out about it for 10 years it's literally like it never happened.

I'm in my thirties and I've never owned a credit card. Fuck paying interest.

People always told me I need to get one so I can have a good credit rating. For what? So I can pay more interest for a mortgage on a house I'll never buy?

Stupid.

Open a savings account and have someone else pay YOU interest.

You only need to pay interest if you don't make your monthly payments. I put gas and some groceries on my card and zero it out every month. By the time I graduated from university I had a credit score of about 775 which is pretty good for a kid who grew up in a <$20,000/yr household with no real financial education or help.

For what? So I can pay more interest for a mortgage on a house I'll never buy?

This is a terrible way to look at credit. You'll definitely be paying more interest with no credit score, if you can even get a loan (you won't). You're pretty much guaranteeing your failure like this.

Open a savings account and have someone else pay YOU interest.

Yeah lmao that 0.3% really pays out big, huh? Most credit cards offer anywhere between 1-10% cash back.

you only pay interest if you miss your payments deadline. I get 2% cash back on every single purchase i make with cc - Last month I got over $50 back.

Meanwhile my savings account I opened with 4% interest and over a grand invested gave me a whopping $5 in the past month.

You do know where that cash back is coming from, right? Everything you buy has credit card fees baked into the price. The business pays anywhere from 1-5% on every transaction to accept your payment, and a small percent of that is returned to you as "cash back" rewards. Its why I've switched back to using cash and any coins I get as change go into a jar. That earns much more than %10 "cash back", and some shops even make the customers pay the CC fee here in aus so I get a small "discount" too.

People always told me I need to get one so I can have a good credit rating. For what? So I can pay more interest for a mortgage on a house I’ll never buy?

Credit gives you options. Furnace goes out way sooner than anticipated and you only have $5k in the bank? Take out a loan for the remaining $3-5k to get it done now. Unexpected car repair and you only have $500 after rent in the bank? Whip out the credit card and put the other $500-1000 on there and throw extra money at it until it's paid off. Yes you'll pay some interest, but you'll have a working car, or a working furnace, or whatever other calamity you find yourself facing.

But the biggest thing credit does it lets you buy property much much sooner in life. Property has a wierd habit of gaining value much faster than it should, the payment stays the same for the entire term of the loan, plus with a mortgage every payment buys you slightly more ownership of the property unlike a rent payment which is just money leaving your bank account every month for nothing other than the privilege of the roof over your head for the following month.

For a real world example, I bought my house a couple of years ago for ~120k. I live in a small town so I figured it wouldn't gain anything other than holding it's value through inflation. My monthly payment is ~800ish and similar places were renting for ~1k/month. Well thanks to the hyperinflation the last couple of years, my house is now worth closer to 180k and rents are up to $1200-1500/mo for a similar place to the one I own, but I still pay $800/mo for my house. That's what credit gets you in the long term. It gets you stability and options for when the going gets tough