It's when you talk through a problem with an inanimate object, traditionally a rubber duck. The process of explaining the problem can help you organize your thoughts and identify otherwise elusive problems. It's a common technique used by programmers debugging their code.

agamemnonymous

Hence the quotes

The "apple" was a persimmon?

Thank you for this. I saw a picture of Spider Jerusalem on a counter culture flyer over a decade ago and couldn't find the source (I wanted those sweet glasses). When I read Invisibles I assumed I found it and it must've been Mob from some promo or alt art.

It was definitely Spider Jerusalem, I found the glasses, and now I get to read Transmetropolitan.

Ariandre the Grande

For me, insurance and property tax work out to about 1/3 of my former rent (which was a smaller place than my current home). My mortgage by itself is about the same as my former rent. Based on what another commenter said about the typical percentage of payment toward interest (69% after 1 year, 55% after 10 years, 33% after 20) after a year my money-in-the-black-hole is roughly even to renting with about 1/4 of my total payment going straight to equity. After 10 years that goes up to 1/3 into equity, after 20 it's about 1/2.

Yes, my total payment is higher, but the home is larger; if I'd made a more horizontal move, the equity building rate would be more favorable. Additionally, I rented that space for 4 years and the rent went up 30%. The main thing to increase my payments now would be an increase in property taxes, which reflect an increase in property value. Personally, I felt very different about a 30% increase in rent than I'd feel about a property value increase that would bump taxes enough to raise my current payment 30%.

All I really did was convert some of what I'd save normally into the form of real estate. Home values typically increase about 3-5% annually, which is pretty comparable to most investment instruments. And I get the material benefit of a neat house to enjoy in the meantime, instead of some holdings with zero non-monetary value.

It's not necessarily the right move for everyone. I am particularly handy, so my maintenance costs are lower than they might be for others. But so far as money-in-the-black-hole and equity are concerned, I'd imagine most people who can shoulder the up-front costs would break even pretty quickly, interest included.

The worst part is draconic abortion bans also hurt those trying to have children. No one's getting recreational third trimester abortions. You picked out a name, painted the nursery. Late term abortions are tragedies to all parties, and only ever happen because of life threatening conditions.

I wouldn't want to plan a child when any complication could mean death.

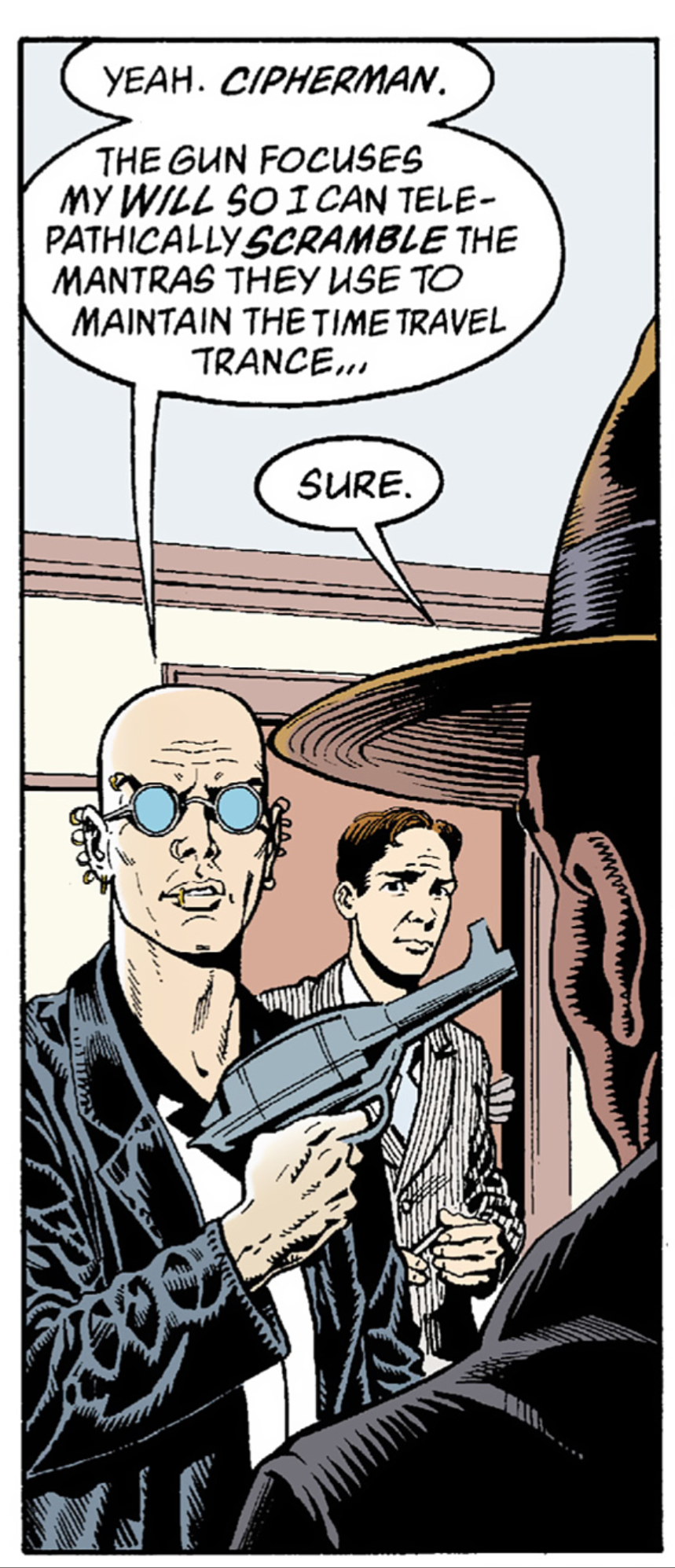

I suppose in a sense our life is a trance, traveling forward through time, and the coordinated nervous rhythms of our vital organs are "mantras" that maintain it.

Strange, but simple

Profoundly incorrect on all counts. I hope your principles drown out the screams, because those of us with brains and hearts will be screaming with them.

I parse "anxious to get going" as being overwhelmed in the interim: restlessness, beset by uncertainty ("did we pack the toothbrushes?", "did we confirm the hotel reservation?", "what does traffic look like?", etc.). The eagerness is for the going itself, the anxiety is for the period up to the going.

My wife, for example, is always anxious about dozens of details and considerations in the lead up to a trip, but once we're actually in the car and en route that falls away. I think a lot of people are the same, where they panic about little details up to an event, but once they've crossed the threshold from lead up to the event itself the prep panic disappears.