Those poor millionaires, being asked to contribute to society. How could you?!

A Boring Dystopia

Pictures, Videos, Articles showing just how boring it is to live in a dystopic society, or with signs of a dystopic society.

Rules (Subject to Change)

--Be a Decent Human Being

--Posting news articles: include the source name and exact title from article in your post title

--If a picture is just a screenshot of an article, link the article

--If a video's content isn't clear from title, write a short summary so people know what it's about.

--Posts must have something to do with the topic

--Zero tolerance for Racism/Sexism/Ableism/etc.

--No NSFW content

--Abide by the rules of lemmy.world

Hey. These hard working millionaires are tricking this money down by buying stocks and investing in real estate and then upping the price of rent to continue to increase their wealth so they can push to the next tier of millionaire".

Which they've hired accountants to do for them. But I assure you, their work lunches are exhausting

Reposting from another thread:

Social security has been 10-15 years away from being insolvent for 80 years. It will always be 10-15 years away from being insolvent because of the way it's calculated.

When the CBO or whoever scores it they can predict certain things like the number of recipients, the size of their payments, and inflation. They aren't allowed to take into account things that Congress may (but definitely will) do in the future, like raising the cap on social security taxes roughly with inflation. It went up from $160200 in 2023 to $168600 in 2024. This is a rare bipartisan, uncontroversial thing. Congress almost always follows the SSA recommendation exactly.

It would be more accurate to say "if the social security cap stays at $168600 for 10 years, social security will be insolvent."

The people pushing this bullshit know it's bullshit. They do it to make people think they'll never get social security so they can get enough voters on board with killing it, like they've been trying to do for 88 years.

Don't fall for it.

Apologies, but your specific example is incorrect. The cap on social security taxes is adjusted every year not by act of congress, but by existing law that indexes the cap to inflation. Therefore, it is already baked into the way it is scored and is not ignored.

You are correct that scoring cannot take into account any actions congress may take.

This time is a little different though than history. From 1984-2020, Social Security took in more in revenue than it paid out on benefits. It is now running at a deficit. Since being formed, it has run at a deficit less than 15 total years, and most of them earlier on. The social security trust fund has never been depleted during that time either. Without any changes to law, it will continue to run at a deficit until the late 2030s when the trust fund would be depleted and taxes alone would cover a projected 80% of benefits.

That 80% is why it's bullshit to your point. There are so many simple, easy ways to solve this and if they do nothing, we could continue to pay out 80% of benefits with no other changes but that'll never happen. It would be political suicide to literally starve our retired population. My favorite way to address it is removing the cap, but there's other small adjustments that make a huge difference. Things like changing the inflation adjustment to a similar but lower index, raising the retirement age, raising the tax by less than a percent, means testing, etc ... and the thing that pisses me off is the sooner we take one of these actions, the more of the trust fund is preserved, and the impact is so much greater. I don't like the other solutions and would strongly prefer raising the cap, but I'd take most of them over inaction, depleting the trust fund, and reducing benefits.

It's still time to scrap the cap of $168,600 income that has to pay in. Pay the full amount on all our income, or GTFO of the US.

It is not going to "run out". That is republican talking point and propaganda. God damn that myth is believed by everyone.

The concepts of solvency, sustainability, and budget impact are common in discussions of Social Security, but are not well understood. Currently, the Social Security Board of Trustees projects program cost to rise by 2035 so that taxes will be enough to pay for only 75 percent of scheduled benefits. ^1

75% of benefits will still be paid in even the worse case scenario. The fear mongering is not necessary.

GenX here. Got some free financial advice in 1993 or so. Asked about Social Security being cancelled because my entire class ('89) said we didn't expect to receive it.

She looked me straight in the eye and said, "No. There will be riots in the streets before Social Security is cancelled. This is a non-issue, you're getting it. Any other concerns?"

GenZ, 30-years later, "We're gonna get cancelled!"

No fuck you won't. Old people vote. Isn't that what they're always bitching about? Think we'll shoot our retirement straight in the skull?!

Also Gen X, graduated in '96, and was warned by my econ/government teacher that we need to have well funded IRAs, because we won't be getting enough social security benefits to even pay for food, much less rent, medicine, or healthcare.

This is what they mean when they say Social Security is basically bankrupt. It won't pay for shit, and I live with people who currently draw on SS. It already doesn't even pay the 1/3 of their retirement it was supposed to. We don't get the retirement plans (pensions) from the companies we work for that was supposed to cover that last 1/3 of our retirements.

It was supposed to be a three-pronged plan: Social Security, 401k, and corporate pension. Each of these has problems on their own, but a hybrid solution could cover for each other's issues.

Now, corporate pensions are rare, 401k's are highly vulnerable to stock market crashes, and Social Security is being slowly strangled.

I know this is false because I've looked into how it works, and it still makes me feel sick to hear every time. Of course, the truth is bad enough, we don't need to lie.

$168,600

That's the cap. It is clearly and obviously only benefiting the rich. Absolutely insane.

It also benefits the upper middle class. And middle class in HCOL areas.

It should be adjusted based on cost of living.

Making $150k in NYC is like making $50k in middle america.

No, it isn't. That's bullshit, a talking point designed to get you to give up on supporting it politically.

But do you know what would help it in actuarial terms? 2 things:

-

raise the federal minimum wage

-

remove the cap on income subject to the social security tax

When suppressing wages became a bipartisan affair, it hurt Social Security just as much as it did workers on the low end of the wage scale.

Everything else aside, social security is not going to run out in 10 years, all the doomsday is if we do NOTHING, but we never do nothing on social security. It's not going to end or "go bankrupt", this is all fear mongering BS that doesn't stand up to the smallest dose of objective reality.

To make SS solvent all they need to do is make higher income earners contribute on the same scale they make lower income earners pay already.

If people making above 140,000ish had to keep contributing at the same rate as everyone UNDER that number does, there would be no issue at all. But a billionaire pays as much into SS as someone making 140k a year, probably LESS because of the Social Security payroll tax income limit.

Tax the rich already!

So just to translate for non Americans: Social Security is a kind of guaranteed old age / retirement pension, by the looks of it.

Yea. 6.2% of each paycheck is taken out for SS and your employer will match it. Then, when you turn 67, you are of retirement age and will start reciecving monthly checks proportional to your income when you were working. There are exceptions but that's generally how it goes

not just social security. top income tax bracket is at the begining of 6 figures and of course there is a discount to corporate tax rates and if you don't make your money through labor.

Yeah why is there a benefit for people who don't make their money from labor? They need to be rewarded for already making more by doing nothing? Nonsense

it's not gonna run out.

it will be far worse, we'll all pay into social security and when we get it back it won't cover the cost of your monthly bread ration.

What is the difference between a CEO and Santa Clause?

spoiler

Both of them judge you all year round, but one of them performs at least one day of work.

At least in principle, social security is a mandatory way of saving for retirement, not simply a tax. In that context, it makes sense that contributions are capped since payouts are capped.

SS Works is

A poorly thought out tag

Could someone explain how it could run out if there are still workers contributing to it every year?

Because it’s paying out/getting raided faster than people are contributing to it

As someone who hits the cap and lives in a place where even monthly premium payments for our healthcare have been scrapped, I am really sure it's time to open up BOTH of them again.

Sure, it's a cost. Sure, it's less cash in my pocket. But holy hell, we need to keep the cash going into the system so the next right-wing nutters can't gut the services via some "fiscal responsibility" bullshit.

Back in the 90s, people were saying the same thing. Al Gore even had an early internet meme made about him saying "lockbox" over and over.

Ten years later I looked into it, and the sense at that time was all the illegal immigrants were contributing in but didn't have a chance of taking the money out, and that saved it.

Did Trump screw us over by changing "catch and release" to "Wait on the other side of the border?"

He kept saying lockbox because there was (and still is) a rumor that Congress has been stealing social security to pay for wars and that's why it's bankrupt.

The reality is that the money is invested in US bonds. Although technically Congress uses that money for wars and other stuff, they pay it back at interest which is overall good for social security (at least compared to cash just sitting there). I suppose if the money was invested instead of being used to buy extremely low yield bonds it could have grown many times over by now, so that's "stealing to pay for wars" by SOME definitions.... But it's not what most people mean with their accusations.

Tl;dr: it's in a lockbox!

Social Security doesn't have assets, it has debt obligations, which to the government, are something you can conjure out of thin air. The only senses in which it can "run out" is if outlays exceed receipts, or if it runs out of debt instruments to cash out and has to ask for a pile of more debt instruments.

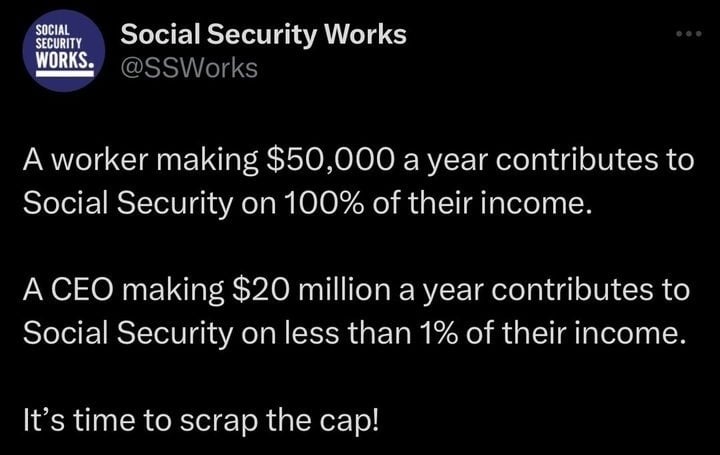

Image Transcription: Twitter Post

Social Security Works, @SSWorks

A worker making $50,000 a year contributes to Social Security on 100% of their income.

A CEO making $20 million a year contributes to Social Security on less than 1% of their income.

It's time to scrap the cap!

"set to run out"

Source? Man I wish Lemmy could have developed its own culture without every miserable thing from r/All coming in here to peddle the usual toxic negativity from Reddit.

Worthless ass Twitter repost