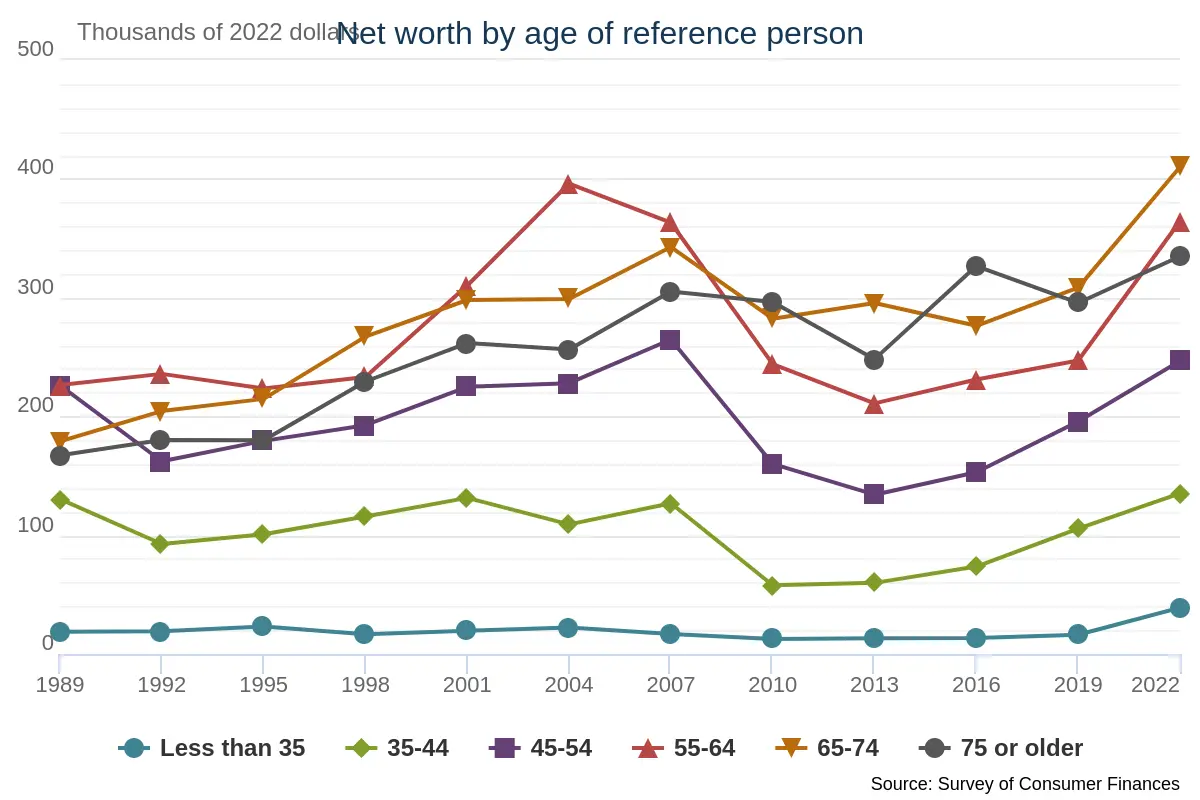

Wow, it took around 15 years to financially recover from the Great Recession for everyone younger than retirement age.

FIRE (Financial Independence Retire Early)

Welcome!

FIRE is a lifestyle movement with the goal of gaining financial independence and retiring early.

Flow Charts:

Personal Income Spending Flow Chart (US)

Personal Income Spending Flow Chart (Canada)

Personal Income Spending Flow Chart (Australia)

Personal Finance Flow Chart (Ireland)

Useful Links:

Mr. Money Moustache - a frugal lifestyle blog

Related Communities:

Wow, those are disappointing medians. If you just max your IRA (no 401k, no match), stay out of debt, and don't sell, you should beat most of those medians by 45 or so if you start at 25, assuming 6% real returns.

This is basically a plot of home ownership rates by age right?

I don't believe so. Home ownership rate would be hard to deduce from net worth because the majority of homes aren't paid off at a younger age. Therefore, whether you have a home or not would be a net wash. However, there are also plots for primary residence value and mortgage debt in the link along with many other interesting data sets.

I wonder why the oldest demographics were so insulated from 2008. Maybe they were less likely to live in areas with a housing bubble? Not living in McMansion city and all that.

Assets in a mix of cash and bonds and no need to sell their house? Just a guess.

Pensions and paid off houses would be factors I would guess.

What's wrong with 55-64 generation? Where did they get all that money?

For all of the 50+ having the most, in general, we may just be seeing the baseline principle that time-in-the-market beats other effects.

For why they have more than their 60s and 70s counterparts, I can only guess.

My guess is the 55-64 generation has less conservative investments than their 60s and 70s counterparts, so they raise higher on a strong market, and fall further in a weak market.