It’s Florida. People aren’t interested in paying huge sums to live in a Republican paradise that floods where you can’t get a mortgage because you can’t get home insurance.

Housing Bubble 2: Return of the Ugly

A community for discussing and documenting the second great housing bubble.

The play is to buy the property with cash and be a landlord, renting to the people who work in Florida and can't buy a house. Florida probably has another 10 to 25 years before the beach fronts get submerged, which is a lot of rent money that will reimburse the buying price of the property.

When Florida finally loses to the sea, apply for government aid and get extra money as a lump sum for a property which has been paid for in full.

I imagine it has a lot to do with Florida, making them fix and repair the problems with the buildings after the last disaster found tons of structural damage that led to it's collapse. Now they are inspected yearly, and the bills are going to them to pay up. On top of that, the prices are higher than they should be because all the contractors know they have to pay and jack prices up. It's a mess, and I know I sure as hell would never want that. On top of that, the rising waters along the coast and the awful governing that's been taking place over the last 5 years or probably more.

Link that talks about the repairs https://www.nbcnews.com/politics/economics/reckoning-coming-floridas-condo-owners-buildings-face-millions-repairs-rcna165764

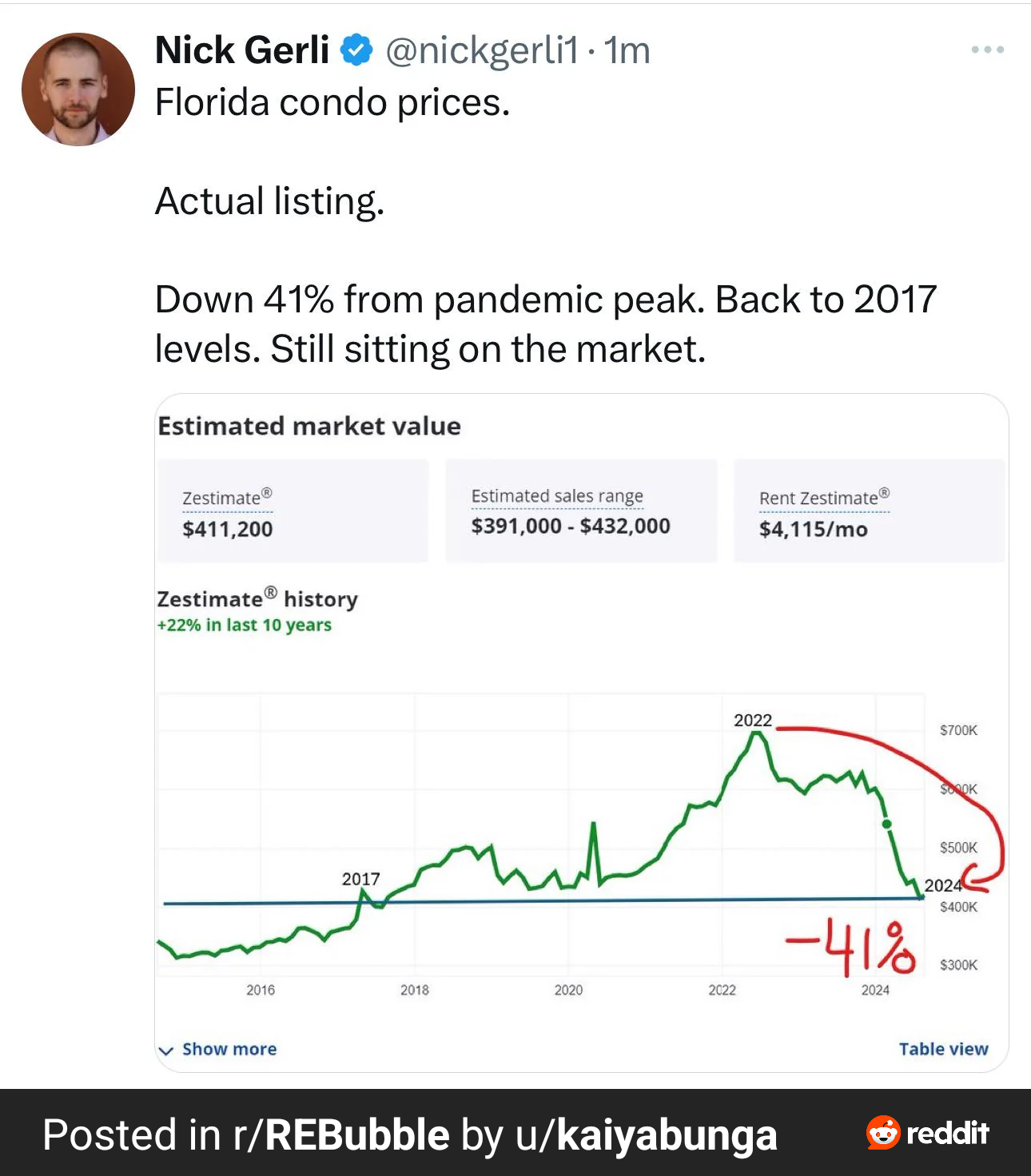

Is this an average or a single property?

Single property

Yes, but the zestimate is derived from large data sets, so a bit of both.

Zillow did famously almost bankrupt themselves so there are definitely reasons to be skeptical about assigning significance to the zestimate.