this post was submitted on 23 Apr 2024

969 points (98.1% liked)

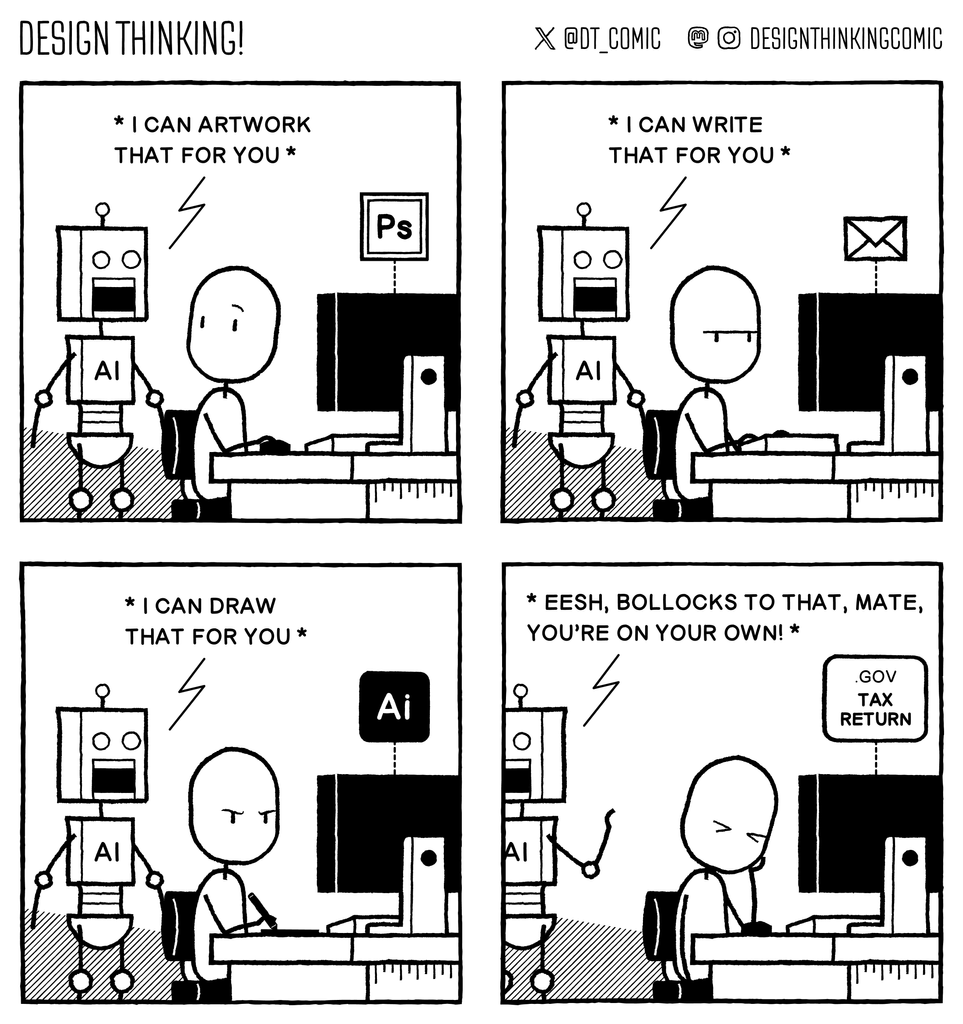

Comic Strips

12975 readers

1608 users here now

Comic Strips is a community for those who love comic stories.

The rules are simple:

- The post can be a single image, an image gallery, or a link to a specific comic hosted on another site (the author's website, for instance).

- The comic must be a complete story.

- If it is an external link, it must be to a specific story, not to the root of the site.

- You may post comics from others or your own.

- If you are posting a comic of your own, a maximum of one per week is allowed (I know, your comics are great, but this rule helps avoid spam).

- The comic can be in any language, but if it's not in English, OP must include an English translation in the post's 'body' field (note: you don't need to select a specific language when posting a comic).

- Politeness.

- Adult content is not allowed. This community aims to be fun for people of all ages.

Web of links

founded 2 years ago

MODERATORS