this post was submitted on 10 Aug 2023

437 points (96.2% liked)

Funny

7915 readers

222 users here now

General rules:

- Be kind.

- All posts must make an attempt to be funny.

- Obey the general sh.itjust.works instance rules.

- No politics or political figures. There are plenty of other politics communities to choose from.

- Don't post anything grotesque or potentially illegal. Examples include pornography, gore, animal cruelty, inappropriate jokes involving kids, etc.

Exceptions may be made at the discretion of the mods.

founded 2 years ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

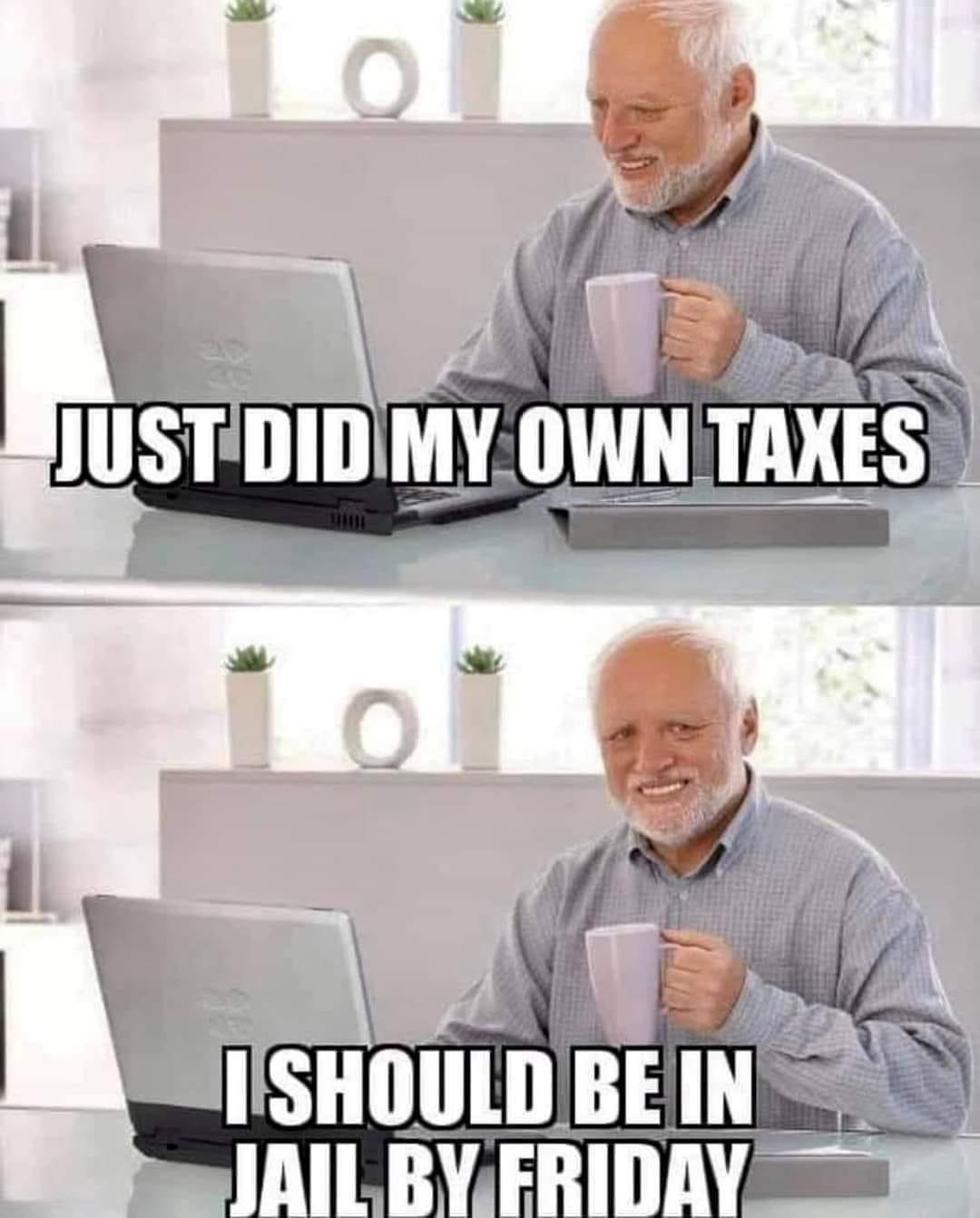

It's really just a meme anyway. I'm American and do my own taxes. It's labyrinthine, but not actually that hard honestly.

The place where individuals get themselves in trouble with the government is the more subtle business related stuff like writing off expenses, carrying forward business losses, depreciating assets, selling stock. That stuff is probably best left to an accountant.

But as a regular person filing with mortgage deduction, college tuition deduction, child tax credits, if you make a mistake the most likely response is just gonna be a letter telling you to try again.

The 1040EZs were a since when I was in high school but still odd of they check anyway why do I still have to do it?

In the past few years we had some more deductions and I had to Google which numbers, forms, or lines I had to put stuff on it felt so damn intuitive to a point I started designing forms to be easier for people, gave up and just let my tax guy do it all from now on.

Oh no, absolutely the government should be compiling this shit for us, and we should only have to double check and sign it like "yep looks right to me"

I was just pointing out that the idea that any little mistake on your taxes will get you put in jail is a meme.

They already compile it, they're just not allowed to show us because the tax companies donate a tiny percentage of their profits to political campaigns.

Pretty sure they already do compile a lot of it. But then we get to play the game of "guess their number" with legal penalties if you guess wrong, so TurboTax can use fearmongering and deception to get people to pay for their software and add-ons.

Intuit and H&R Block have lobbied into the millions of dollars over the years to ensure that our taxes work exactly this way.

To date I have never used either of their products and I never will. Fuck them. Now if only literally everyone else felt the same so that they could promptly go out of business…

IRS has free file forms

https://www.irs.gov/filing/free-file-do-your-federal-taxes-for-free

They'll only help if you have an AGI less than $73k. They built a whole system to help and don't let some people use it not because of more complex tax situations, but due to an arbitrary income limit.