this post was submitted on 14 Jun 2024

1462 points (99.2% liked)

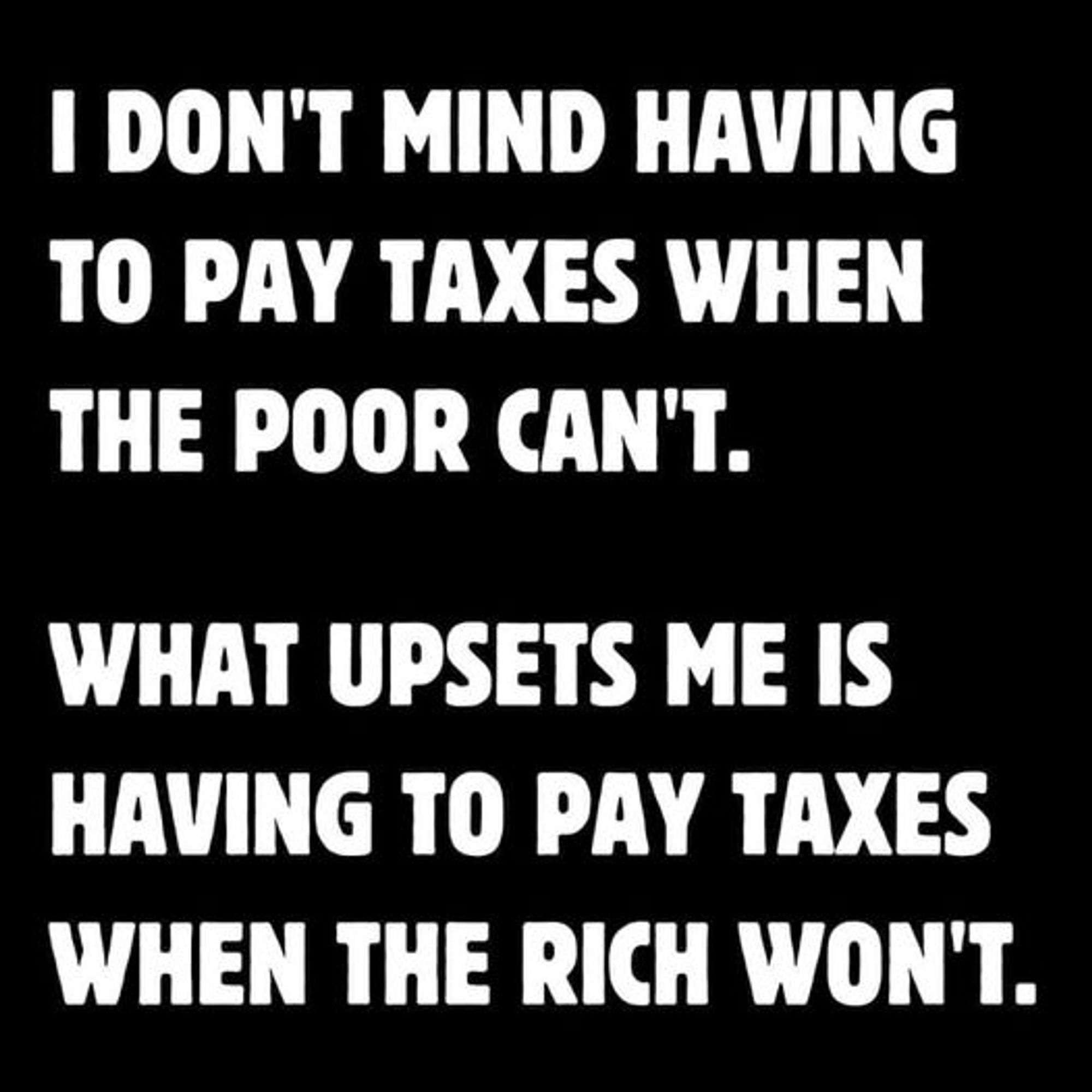

Political Memes

5087 readers

4653 users here now

Welcome to politcal memes!

These are our rules:

Be civil

Jokes are okay, but don’t intentionally harass or disturb any member of our community. Sexism, racism and bigotry are not allowed. Good faith argumentation only. No posts discouraging people to vote or shaming people for voting.

No misinformation

Don’t post any intentional misinformation. When asked by mods, provide sources for any claims you make.

Posts should be memes

Random pictures do not qualify as memes. Relevance to politics is required.

No bots, spam or self-promotion

Follow instance rules, ask for your bot to be allowed on this community.

founded 1 year ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

I think you can change stuff around the legal definition of marriage and family separately from the tax break part. I'm not an expert, but if you're interested in this sort of thing I recommend "The Whiteness of Wealth": https://www.penguinrandomhouse.com/books/591671/the-whiteness-of-wealth-by-dorothy-a-brown/

From another article about it: https://www.wbur.org/hereandnow/2021/05/17/us-taxes-dorothy-brown