this post was submitted on 15 Apr 2024

722 points (98.0% liked)

Funny

6915 readers

483 users here now

General rules:

- Be kind.

- All posts must make an attempt to be funny.

- Obey the general sh.itjust.works instance rules.

- No politics or political figures. There are plenty of other politics communities to choose from.

- Don't post anything grotesque or potentially illegal. Examples include pornography, gore, animal cruelty, inappropriate jokes involving kids, etc.

Exceptions may be made at the discretion of the mods.

founded 2 years ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

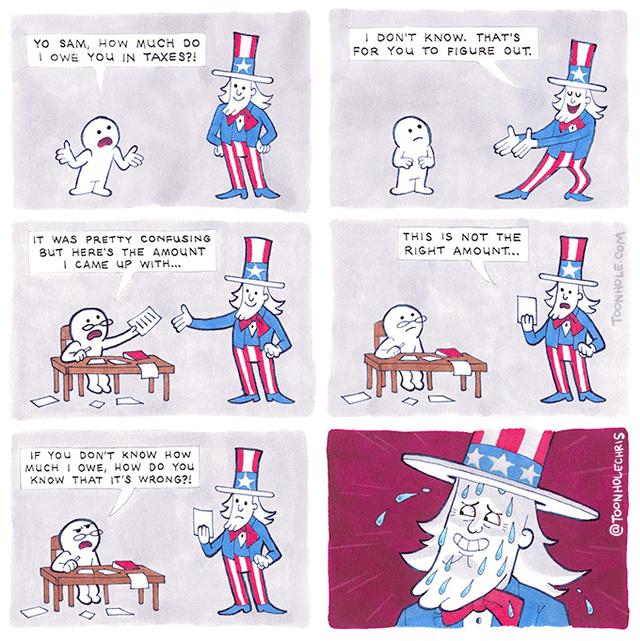

He only knows because your employer ratted you out

Your employer doesn't know all your sources of income if you have independent stuff going on.

If you have taxes witheld the will know. Only way to avoid that is through contract labor cash only

What? No. They only know the amount you asked them to withhold, and that could get you in trouble if you specify dependents then tell everyone you don't have any or something. Also if someone is living in your house, making less than 4700 for the entire year, they can be claimed as a dependent, which means you don't even have to have kids. How would your work even know?

W4

Most of that stuff is pretty optional, and that's for automatic withholding info. You can correct this all on your tax return. This form is more for you to have convenience during return time, and it even says you can exempt yourself from the form for multiple conditions. I don't see why you need to get paid in cash still, like your original comment.

Already completed my taxes and been refunded. Even jad to pay $100 is penalties for not paying the total of 2022s bill. So i'm done til next year

Ok but what about this... W5. Checkmate.

What is that? A state tax form?