But i'll trickle down? Right? RIGHT??

Enshittification

What is enshittification?

The phenomenon of online platforms gradually degrading the quality of their services, often by promoting advertisements and sponsored content, in order to increase profits. (Cory Doctorow, 2022, extracted from Wikitionary) source

The lifecycle of Big Internet

We discuss how predatory big tech platforms live and die by luring people in and then decaying for profit.

Embrace, extend and extinguish

We also discuss how naturally open technologies like the Fediverse can be susceptible to corporate takeovers, rugpulls and subsequent enshittification.

Will it ever?

It's the same in Germany, people listed the actual tax cuts that'll happen per income bracket for each of the major parties, and surprisingly the nazi party that keeps drumming up the "We're the common man's party!!!!!!" is the one that wants to make the rich richer.

And if you want to make the rich more richer than the fucking FDP, a factually one-man party by a guy that can only comment "But what about Porsche drivers?!" to any problem you put in front of him, wow are you a rich assholes party.

Remember, fellow Germans: Today we vote. And if on the way out you vote with your fist in the face of a nazi or nazi-sympathizing voter, that's a bonus!

Unfortunately, disinformation seems to be the winning strategy.

From an American: sorry for Facebook, Twitter, all that... Both our parties are kinda bought by big tech, and it's affecting y'all too.

And that's why i said that US is just speedrunning things.

The only way the folks who need to see things like these infographics will see them though:

you can shove it up their ass and they'll still vote for him

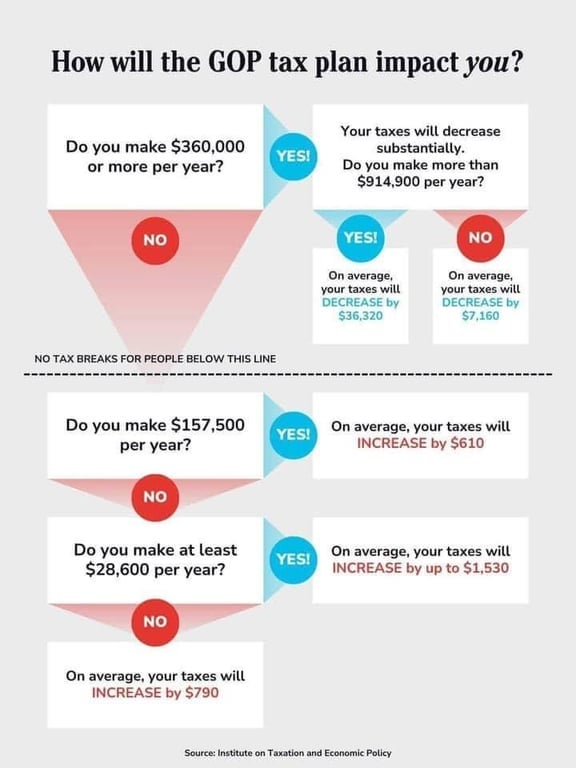

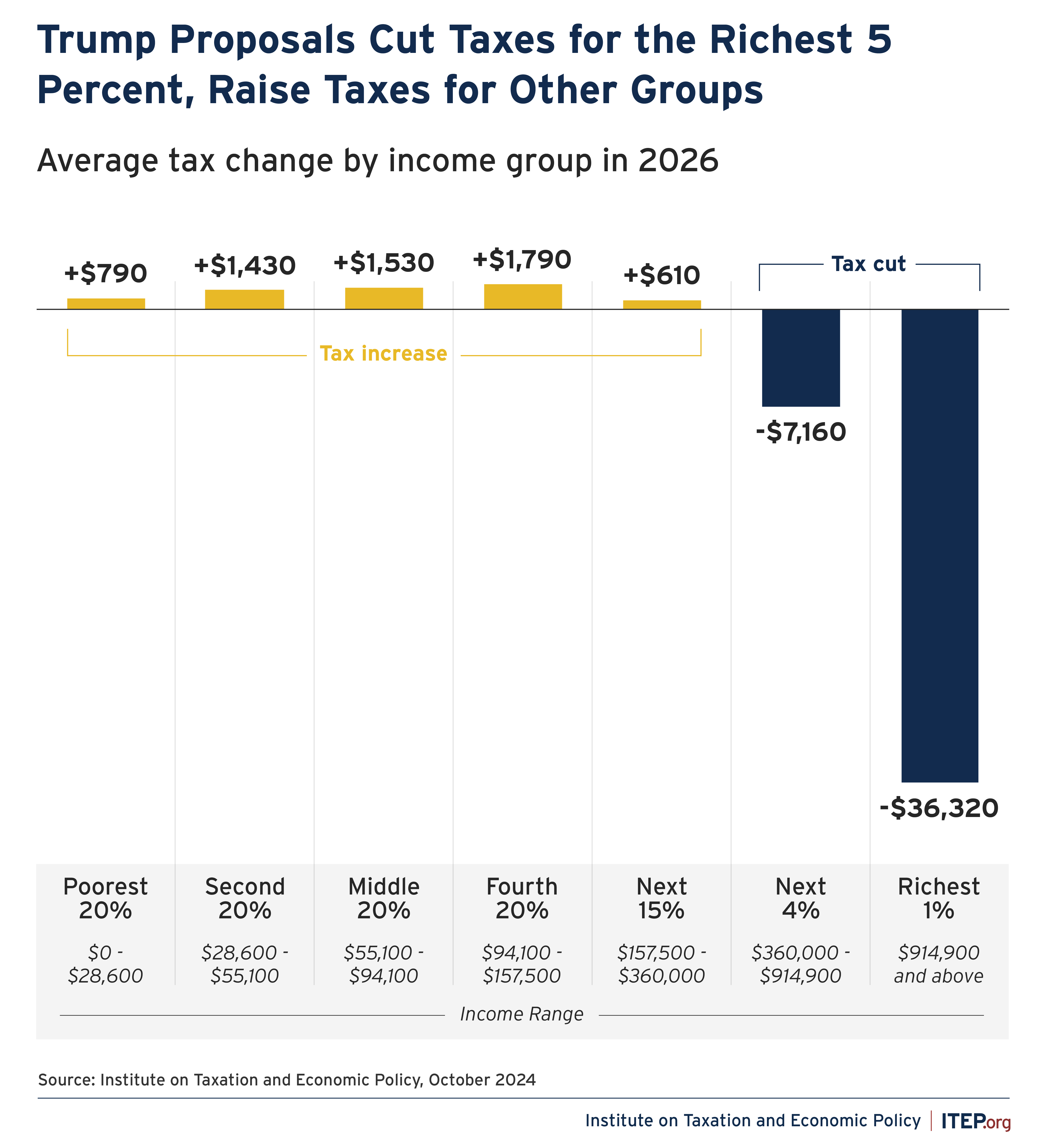

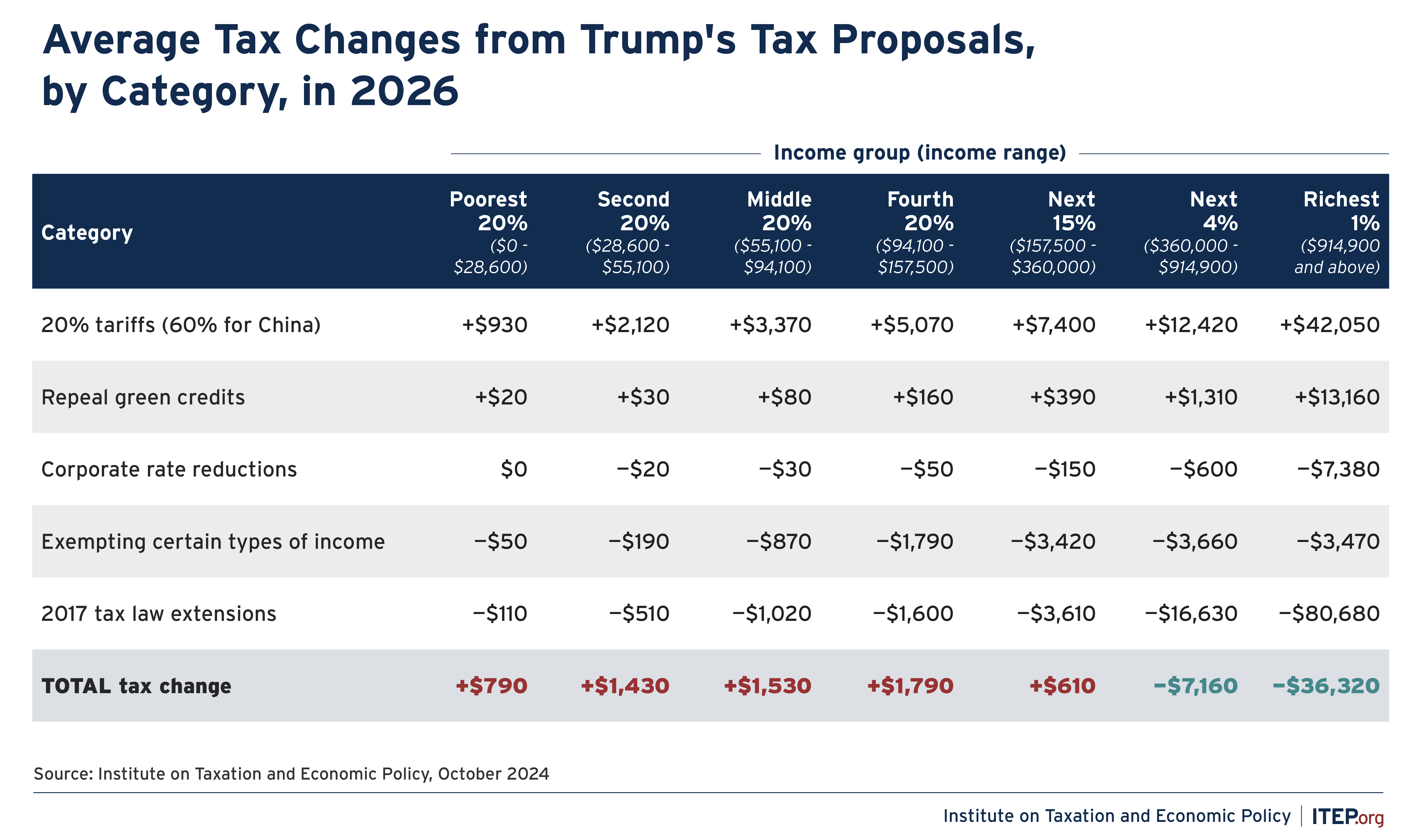

Looks like income tax is reduced across the board. And the increases come from removal of IRA rebates and adding of tarriffs.

From your link:

Yeah, this is what every economist in the country has been saying for the last 3 months. These idiotic tariffs are going to screw every middle to lower class American.

You live in a serfdom

A tax increase is never fine and Trump is only gonna use it to fund the rich.

However there will be a tax increase if the US ever get’s social security.

Why will there be a tax increase?

Not OP but, I think the top earners would be taxed more. To the best of my understanding there is currently a cap on social security for the highest earners.

Most countries already have a budget deficit or at least they generally will when they start increasing the social security budget. So when the US starts to really fund a social security system taxes will increase. If you calculate the marginal tax income (so tax paid + the missed social security others get) it means that a lot will see a tax increase as well.

Print, laminate and start ticking this up around your local town centre.

America, the home of enshittifiction!

making 30 k a year and having to pay even 1600 in taxes

That's like 5.3%, could that be real? That would be ridiculously low. I just checked and with that same income I'd be paying 2480 in Germany, or 8.3%, and that's in taxes alone. After social insurances and health insurance the total deduction would be 6450 or 21.5% total.

That's not the total, that's how much the taxes will increase by. So $1600 on top of whatever you're currently paying. Most of that will be in the form of tariffs on pretty much any goods you buy that aren't made within the country.

LOL to the moon. Factor in the cost of healthcare, a long vacation, a maternity leave and education here. Bet that would cost you WAY over 21.5% here.

Do you have local taxes? We have state taxes, house taxes, etc, so not sure what the equivalent would be.

I can’t say anything about the validity of the infographic but it says “increase up to” so it’s relative not absolute. So without knowing the current taxation it would be hard to say that tax is low, unless you think the increase is too low. Or am I missing something?