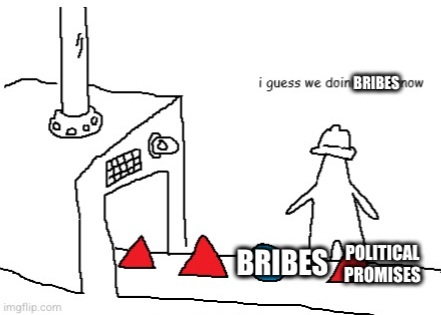

Groceries are unaffordable because nearly monopolistic businesses are increasing prices. And instead of investigating and enforcing heavy regulation of the distribution and sale of essentials in Canada to make groceries affordable we are going to remove taxes so that these businesses can keep their profit margin.

🤡 We are the dumbest western country by far.