this post was submitted on 28 Jan 2024

160 points (96.5% liked)

InsanePeopleFacebook

3420 readers

25 users here now

Screenshots of people being insane on Facebook. Please censor names/pics of end users in screenshots. Please follow the rules of lemmy.world

founded 2 years ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

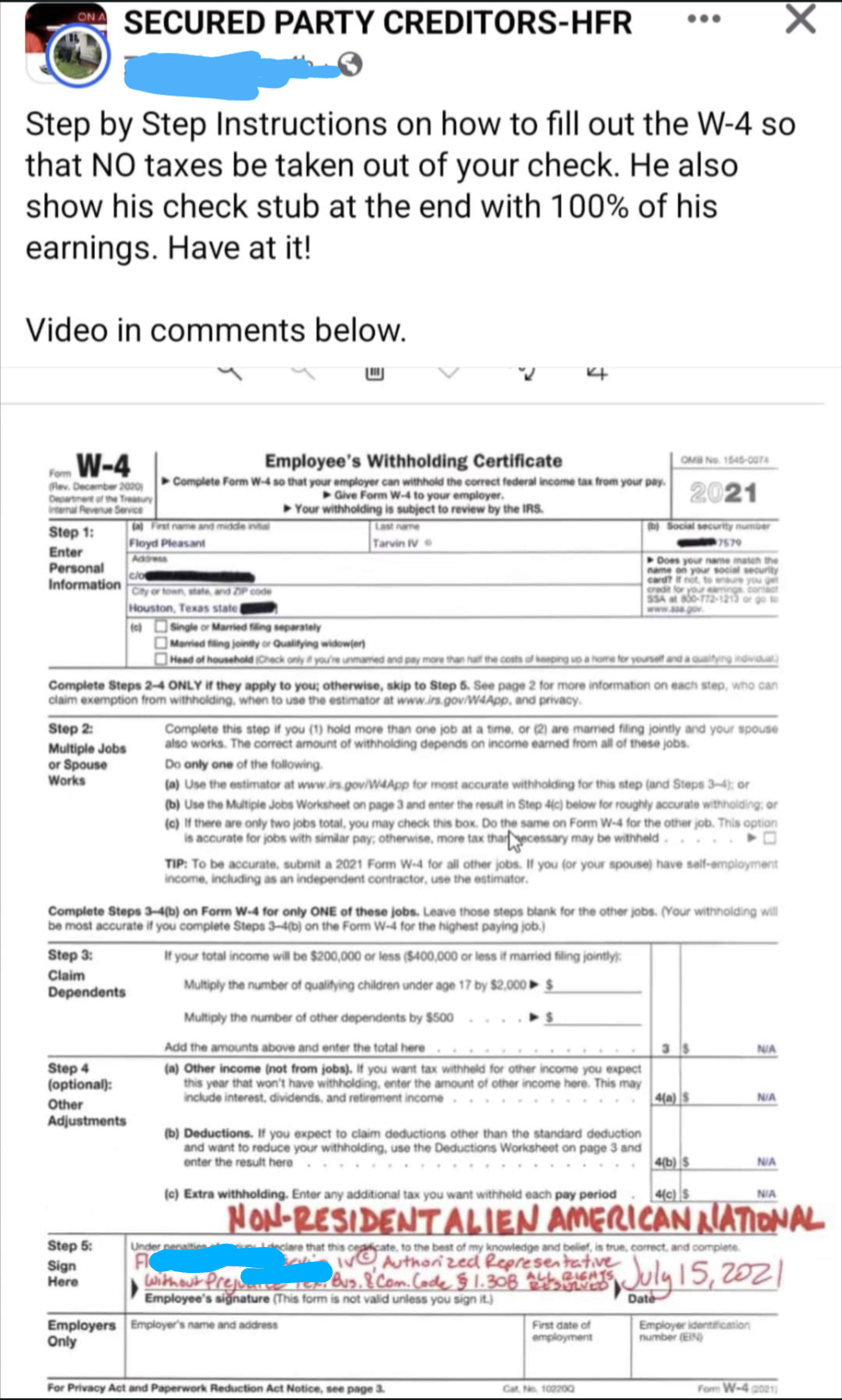

I’d argue that it’s perfectly fine to lie on those or to mark zero. It’s just a way to calculate tax withholding. If you follow it, you’re not likely to go wrong but if you don’t, it’s all on you

There's a HUGE difference between falsifying information (lying) on federal forms, and not having your employer withhold taxes on your paycheck.

IRS FAQs for W-4 say both that it’s not mandatory and how they’ll treat it if you just sign and return as in the example

I don’t believe a W-4 ever goes to the IRS, it just tells your employer how much in taxes to withhold from your pay. IRS doesn’t care, until it’s time to file taxes, then you’d better have complied with all tax regulations