this post was submitted on 02 Dec 2024

981 points (98.6% liked)

memes

10629 readers

1831 users here now

Community rules

1. Be civil

No trolling, bigotry or other insulting / annoying behaviour

2. No politics

This is non-politics community. For political memes please go to [email protected]

3. No recent reposts

Check for reposts when posting a meme, you can only repost after 1 month

4. No bots

No bots without the express approval of the mods or the admins

5. No Spam/Ads

No advertisements or spam. This is an instance rule and the only way to live.

Sister communities

- [email protected] : Star Trek memes, chat and shitposts

- [email protected] : Lemmy Shitposts, anything and everything goes.

- [email protected] : Linux themed memes

- [email protected] : for those who love comic stories.

founded 2 years ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

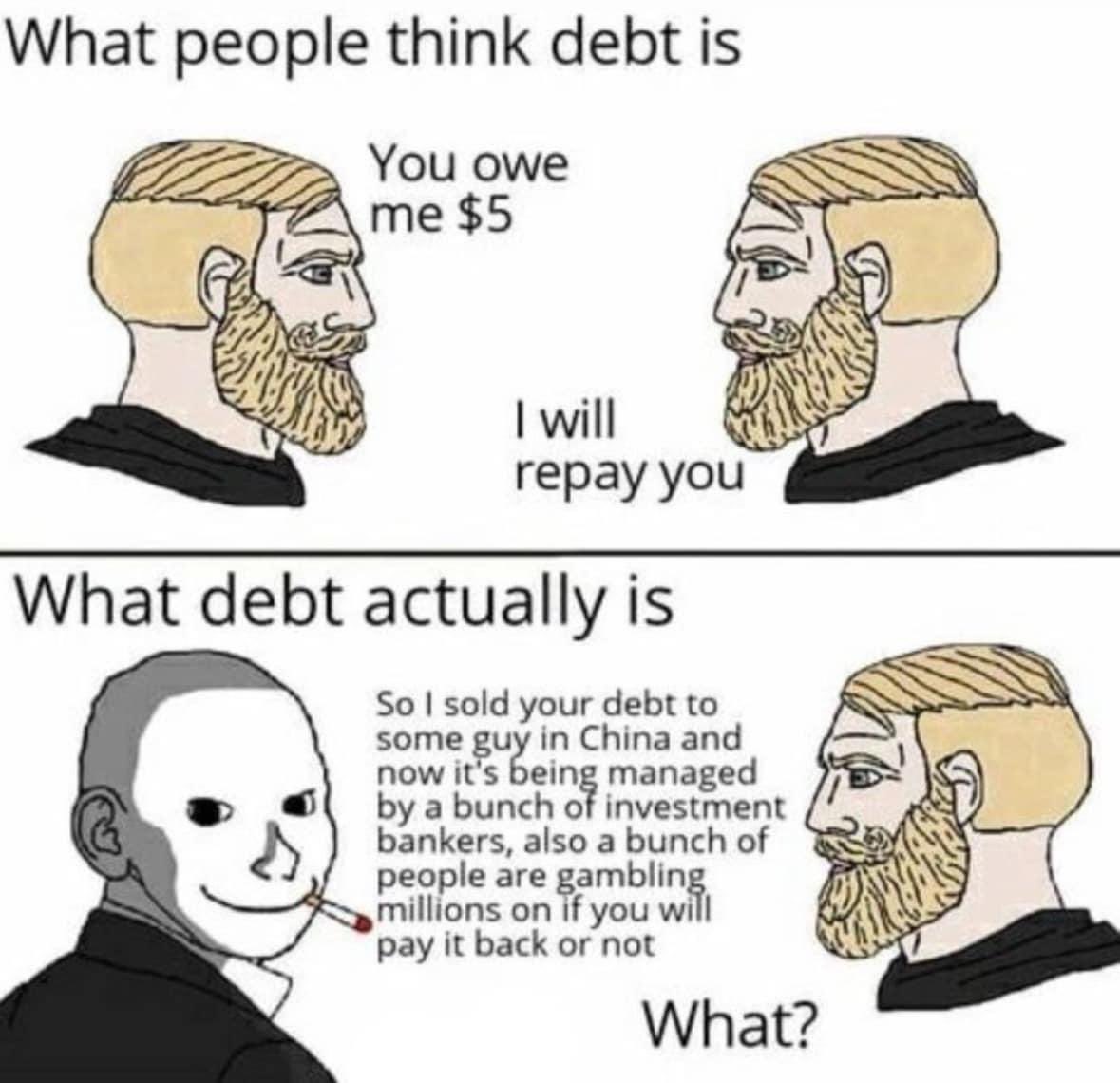

Money is literally an "I owe you"

When money was first used, instead of exchanging an apple for an orange, X amount of apples is exchanged for a dollar. The dollar is the buyer saying "I owe you" to the seller.

When the apple seller now use the dollar on something else, that's just selling the "I owe you" in exchange for something else.

Spending money is just selling debt.

(At least that's how money has always worked in my mind. Listen, economy is weird, idk how this shit works, I'm just coming up with my own explanation okay.)

Historically, debt existed before money existed. But that only works in a framework where people can trust eachother to repay the debt.

Debt: The First 5000 Years by David Graeber is a cool book about this whole topic

I also liked Economics of Money and Banking, a course by Prof. Mehrilng of columbio university, which is available through coursera (1).

It's not the buyer saying "I owe you", but the issuer of the currency (actually, usually just the notes, coins are considered to have value). The first person/entity to get the note gave, or promised, the issuer (usually the central bank) something of value, and the issuer gave them a token (note) saying the bank owes the holder of that note a certain amount of value. The recipient can then trade that note freely, as can future recipients, in the knowledge a vendor will accept it for its face value. So, yes, you're trading debt when you use money, but it's the bank's debt to the holder, not the debt of the buyer.

Typically the bank issue money when someone takes a loan, i.e. promises that they will pay the bank the value of the loan plus interest.

I have a bunch of letters from my family dating back to the civil war. It's fascinating how many IOUs there are in there for like a bushel of apples, or a scrap of leather, or whatever they traded to their neighbors. Like you said, scraps of paper with IOU were literally used like currency, but the real currency was people's reputation to make good on their debts, the paper was just to track it.

Bartering also assumes, for your example, that the apple farmer wants oranges and the orange farmer wants apples. Consider that either one may not. And then consider how many other goods exist even in primitive agrarian society that people may or may not want at any given time.

Currency is whatever the agreed vehicle is for value exchange that solves this. The apple farmer can now sell apples for silver nuggets and use the silver to buy tools from someone else later, which the orange farmer either doesn't have or is unwilling to part with. It allows for more complex transactions that then helped grow more complex societies.

No, you're right! This is exactly why adjusting interest rates by the bank issuing a currency affects how much money is in circulation.

I get why you see it as that but the big thing is that when you have money you basically did something to earn it. You get it after the fact. Well except for the issuer. Debt changes that where you get it ahead of time. Curiously this has been used by the issuer in modern times to determine how much to issue.