this post was submitted on 16 Jul 2024

679 points (98.2% liked)

InsanePeopleFacebook

2666 readers

1 users here now

Screenshots of people being insane on Facebook. Please censor names/pics of end users in screenshots. Please follow the rules of lemmy.world

founded 1 year ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

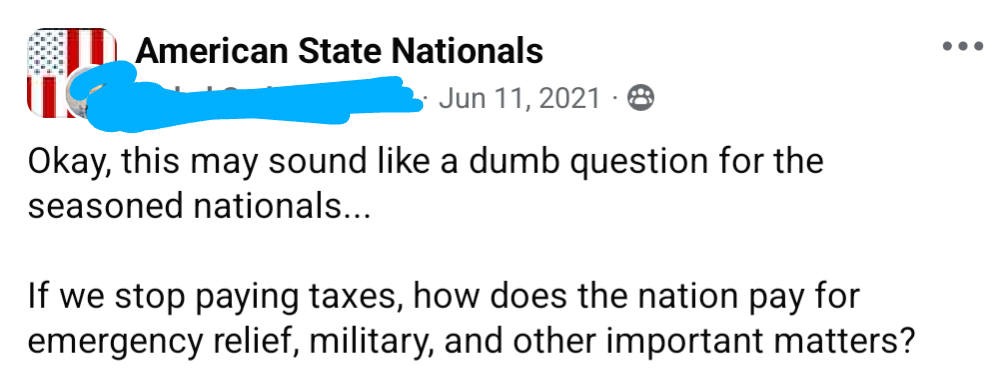

Fun fact: The government doesn't actually need to use taxes to pay for things. The amount of currency in the market isn't fixed, and so the government actually is fully capable of "printing more money" however, this has the potential to cause rapid inflation. So, taxes are a way of reducing inflation, rather than paying for government services.

That's assuming printing money is the default solution. Taxes have existed for longer than that. The earliest taxes were literally a portion of a farmers harvest. You can't just print more food, or gold, or whatever else. Printing money to fund government was never really an option, so positioning taxes as a solution to inflation just doesn't make sense. It's like saying that instead of eating at a restaurant, you could eat roadkill, which you aren't going to do because of disease, and therefore restaurants are a way of reducing disease rather than providing food.

I'm not operating with a model of solutions being "default" or not, so no it absolutely does not. What I'm doing is intentionally ignoring the historical context of how these systems developed to observe how they work in the present moment. Doing so allows me to understand the flaws of the model where money is viewed as a resource, rather than a pure social construct that exists in the minds of those who use it. Resources are limited by physical reality, whereas money flows like a clockwork river who's source is infinite and who's sink has infinite capacity. Changing the ammount of money available too much, too quickly, or in particular ways has negative consequences but it is possible. Resources don't do that.

I'd say they have more to do with entertainment, but they do all of those, yes. It's just a matter of perspective.

There is a Planet Money (podcast) episode about this. It's a fairly new economic theory, but actual PhD level economists have said this. Government prints money, and to bring down inflation they need to get taxes to reduce the amount of money in circulation, to control inflation. The epidsode was in the 2019 timeframe, I think.

Something that absolutely works in the abstract, but kinda hard to fit into my current model of reality.

You have to look at it from the perspective of mathematics, like systems control theory and balance / equilibriums. Money flow is comparable to energy flow. Mathematical equivalence principles allows for multiple descriptions of the same phenomenon because every externally visible system behavior can be implemented in many different ways.

So even if that's not how the underlying implementation looks like, you can switch the system to work like that without changing anything about how you interact with it. And that allows you to analyze the system in different ways that might not work in the current system

I'm a mathematician, so yes; I can confirm. 😂 I was trying to avoid that comparison, but I did use the same techniques I use to compare algebras when my sister and I stumbled on this way of thinking about the economy. I've never heard of systems control theory, though.

It's not really abstract, it's pretty close to how advanced economies already work in practice. Fiat currency is the proxy by which goods and services are valued and exchanged. It is the underlying goods and services themselves which actually have intrinsic value, and printing money doesn't actually change that. Deficits are inflationary and surpluses are deflationary. Growth is deflationary and recessions are inflationary. Governments in these economies will always run deficits because you can't have both growth and a surplus at the same time. At the end of the day macroeconomics isn't balancing a spreadsheet as much as it is about balancing the money supply and economic activity.

This is also why something resembling capitalism is pretty much inevitable in an advanced economy where scarcity is a factor governing economic behavior. If you are using a fiat proxy to mediate economic inputs and outputs, you will end up with market forces. Pretending you can centrally plan around that is naive, which is why harm reduction is the right strategy.

Except that money is put back into circulation through government spending, especially when they're running the kind of deficits we see in the US.

Taxation is a big part of the reason why fiat money has any value at all. By demanding to be payed with its own currency, a government can ensure that the bills it issues will always have demand (because people will need it to pay taxes) and therefore will always have value.

Yes, exactly!

That only happens if you put all that money into circulation - if you were to, say, just give it away as a handout to the military or Israel... no inflation. Which is... exactly how they give handouts to the military and Israel.

To think... they could just as easily spend that thumb-suck money on healthcare - but that won't murder brown people, so they don't do it.

How do you give a handout to the "military" without putting that money into circulation?

That's the beauty of "trickle-down" economics - it doesn't. Give it to the military and the parts of it that doesn't get hoarded by MIC billionaires gets spent on things such as R&D and asset/infrastructure development and maintenance - there's not a lot of that money "trickling" down and circulating amongst the general population.

If you were to spend it on health infrastructure and development, the money will still not be "trickling" down - but the benefits will. A bunch of F-35s means next-to-zero benefits for people - but a functional hospital does.

Even so bud, every cent used in R&D is already in circulation

Even the hoarded money, it's not in an evil lair, it's in some bank, in circulation, making money for the hoarder.

It may have a slightly less inflationary effect but this money is as much in circulation as the single going into a strippers thong

Since the USD is considered the world reserve currency, the government is capable of doing wacky shenanigans like that. Inflation, so long as the American people are insulated from it, could theoretically be used as a way to extract wealth from other nations. It wouldn't surprise me to learn that they're actually already doing exactly that.