this post was submitted on 10 May 2024

1575 points (98.7% liked)

Memes

9401 readers

44 users here now

Post memes here.

A meme is an idea, behavior, or style that spreads by means of imitation from person to person within a culture and often carries symbolic meaning representing a particular phenomenon or theme.

An Internet meme or meme, is a cultural item that is spread via the Internet, often through social media platforms. The name is by the concept of memes proposed by Richard Dawkins in 1972. Internet memes can take various forms, such as images, videos, GIFs, and various other viral sensations.

- Wait at least 2 months before reposting

- No explicitly political content (about political figures, political events, elections and so on), [email protected] can be better place for that

- Use NSFW marking accordingly

Laittakaa meemejä tänne.

- Odota ainakin 2 kuukautta ennen meemin postaamista uudelleen

- Ei selkeän poliittista sisältöä (poliitikoista, poliittisista tapahtumista, vaaleista jne) parempi paikka esim. [email protected]

- Merkitse K18-sisältö tarpeen mukaan

founded 2 years ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

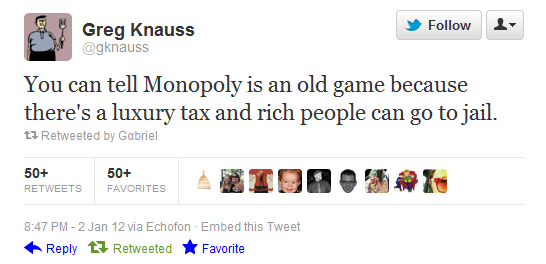

It also had a second rule set where a land value tax was implemented, and the winning condition was when everyone made a minimum amount of money.

It's just a stupidly good tax policy, and we should be implementing it in more places.

[email protected]