jersan

nice post OP! love your original art.

it often takes me a while to figure out what it says when looking at the static images. this one took me a solid 2 minutes.

TERMINATE DSPP!

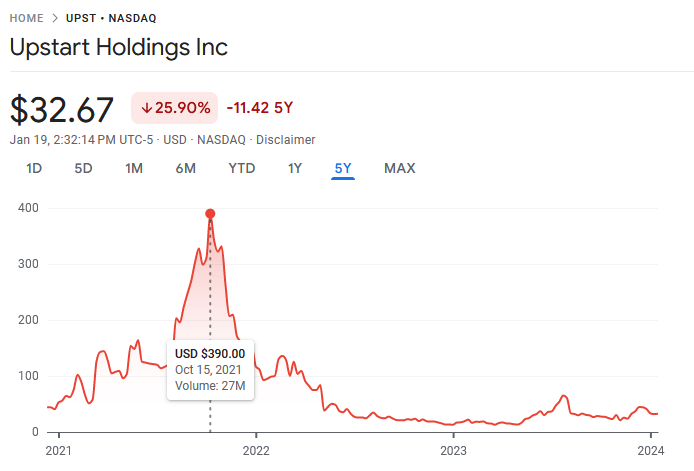

Another example, January 29, 2024.

Why do they do this shit? What possible benefit do the moderators of superstonk get by posting this? Why are they trying so hard to stay in control of the narrative? Why do they act as if they are an authority on this topic?

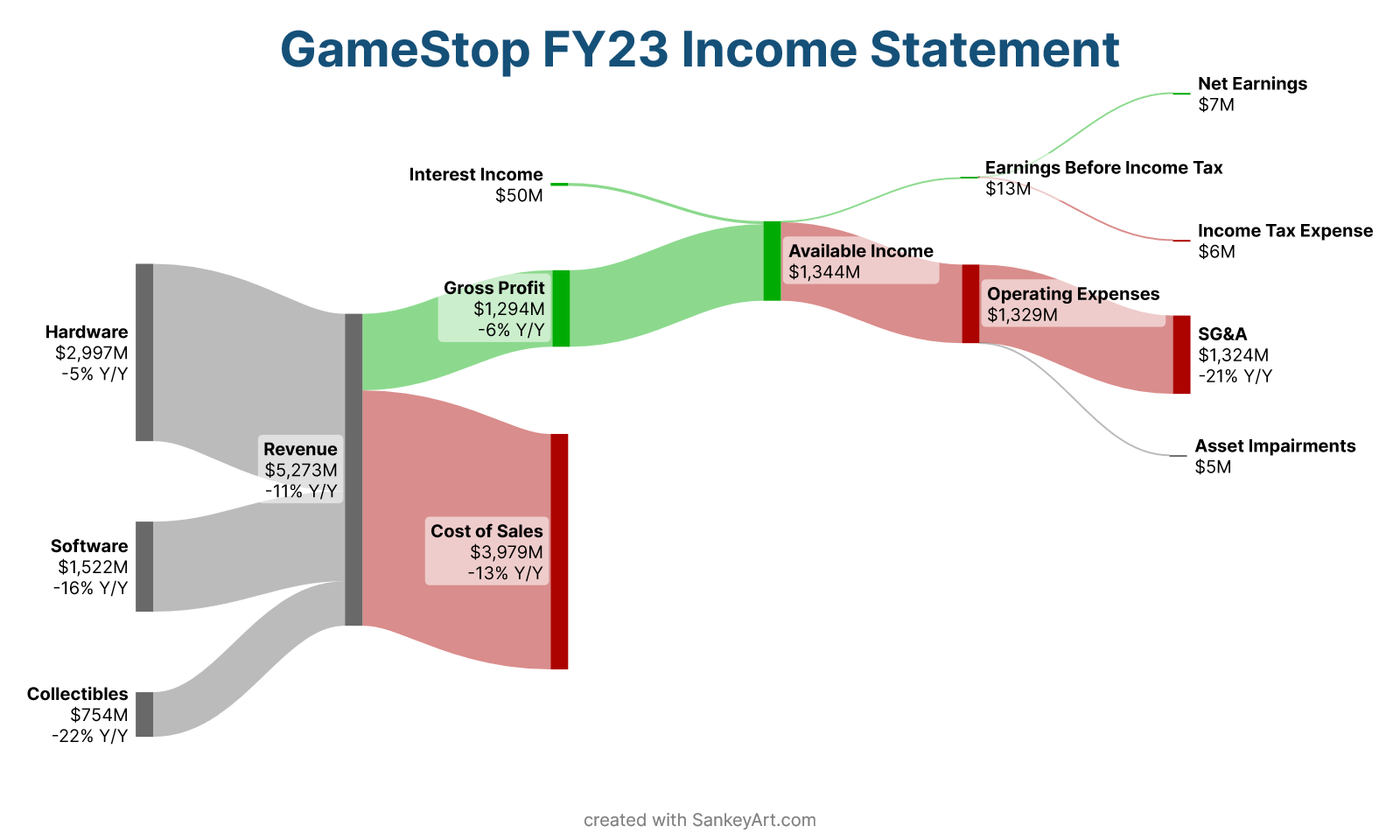

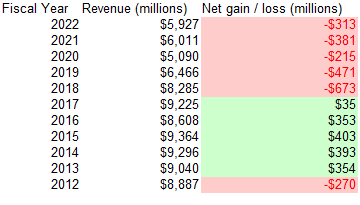

sorry, correction, not ALL of the information in the chart was exclusively from that section of the 10-Q, there was also this section of the revenue:

all in all it was a decent movie.

"but it doesn't talk about [insert thing here] so therefore it was not good!"

i disagree with that notion. no such thing as bad press, and all that, and this movie isn't even bad press. it was fun and entertaining, which is typically the purpose of most movies. it was not a fact-based documentary, it's hollywood entertainment that is shining a light on an important story.

i do find it funny how much hate the movie is getting in superstonk.

In any kind of situation, sorry if I sound like a broken record here, but I always ask myself: who benefits?

We know that Public Relations is something that exists as an industry and as a component of businesses. Businesses use PR in order to shape public perception, away from something negative and sensitive to the business and towards something positive and helpful for the business.

E.g.: what did tobacco / cigarette companies do when research started coming out demonstrating that cigarettes caused cancer? Were those companies honest and forthright, and admit to this true reality even though admitting it would hurt their sales? Or did they do everything in their ability to obfuscate the truth and confuse people, because those actions led to an outcome of continued profits for the company?

We know that wall street and other industries make use of shill farms. Shill farms are basically the modern evolution of PR. If you are a wealthy and powerful incumbent and you are not using shill farms, you will fall behind and lose control of the narrative.

so, in a contest of "promote Dumb Money because it brings positive attention to GameStop", versus "Dumb Money sucks and was bad and was not good and I hated it and it didn't properly represent the story", which one of these thought processes is helpful to GME investors and which one is not?

And in consideration of that, why is it that superstonk is so loaded with antagonism towards this movie?

I think you might be right, though it is impossible to know for sure.

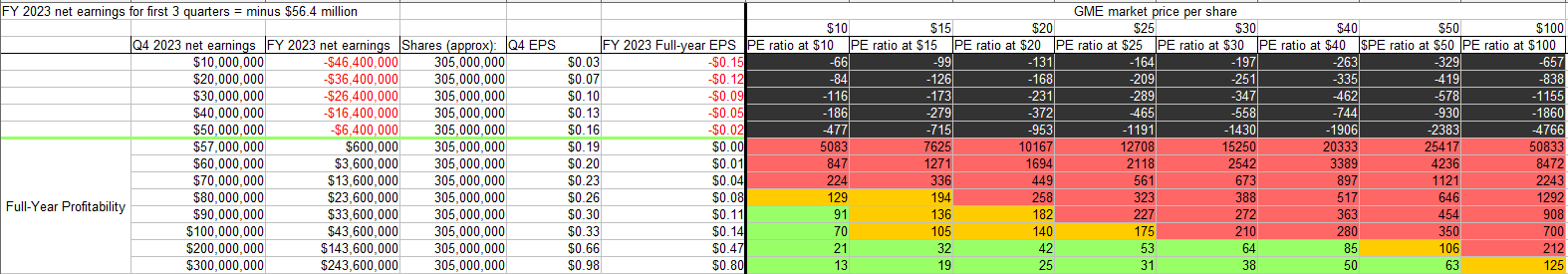

Like how the price started pumping a few days prior to December 6 earnings because those earnings were going to be decent and cause a positive reaction. So they get ahead of the positive reaction by preemptively pumping it beforehand for the purpose of preventing or slowing any momentum. This is what i suspect happened and may happen again in March of this year prior to earnings date.

Another kind of example of the censorship and confusion on this topic that continues to happen to this very day. It is for this reason why the subject needs to be repeatedly discussed and understood by as many GME shareholders as possible, because to this very day they continue to censor and confuse this topic to varying degrees.

January 23, 2024: a post that provides good information about the distinction between DRS and DSPP numbers gets removed from superstonk.

Even if well intentioned, posts like these ultimately are encouraging selling of shares, turning off autobuys, and sowing distrust in ComputerShare. The sources provided don’t back up these claims and how one person is interpreting this does not mean it’s fact. Please do your own due diligence when it comes to making decisions for your investment. Rule 6.

Why is this topic so contentious? Why has there been a sustained campaign to censor and confuse this specific topic, the topic of the distinction of DSPP and DRS, the fact that plan is not DRS?

Who benefits if it is crystal clear and all GME investors understand the truth? GME investors benefit. Who benefits if it is confusing and controversial and omitted (censored) from conversation? Not GME investors.

Great post. Insightful but not surprising.

From the perspective of a money-seeking billionaire like this, everything in the world is only as valuable as its measurement in dollars. Really, this type of behavior is completely normal and maybe even "smart", from the perspective of a capitalist system that rewards greed above all else.

If I am not mistaken, I also read that both Meta and Google, during the big hiring spree of 2021 / 2022, deliberately over-hired thousands of employees with no real work for them, just so that the competitors couldn't get those employees.

Imagine having so much excessive money that you can pay thousands of employees just to do nothing, simply so that your competitors might not get them.

Corporate behavior in modern capitalism is pretty fucked up. It's great if you are one of the few ultra wealthy individuals and all you care about is making more money than you even know what to do with. But beyond them, it's a ruthless and unfair system that will spit you out without a second thought, if it means some rich bastard can make even more money.

I agree!

I did start such a list but it is by no means comprehensive. Someone can take that info and expand on it :)

oh man. thanks OP for reminding me of this.

I was going to leave a comment here but I am going to make a post about it in stead.

TLDR:

CNBC is financial propaganda designed to further the interests of its owners.

The owners of CNBC is Wall Street, and what Wall Street wants is more money and power for themselves and less for everybody else.

Therefore, CNBC's purpose for existence is to help Wall Street get more money and power for themselves and less for everybody else.

"Don't forget to make sure your dividend reinvestment plan is set up again!"

Why? Why say this?

the truth is leaking beyond superstonk's walls. Can't have that.

the truth is leaking beyond superstonk's walls. Can't have that.