memes

Community rules

1. Be civil

No trolling, bigotry or other insulting / annoying behaviour

2. No politics

This is non-politics community. For political memes please go to [email protected]

3. No recent reposts

Check for reposts when posting a meme, you can only repost after 1 month

4. No bots

No bots without the express approval of the mods or the admins

5. No Spam/Ads

No advertisements or spam. This is an instance rule and the only way to live.

A collection of some classic Lemmy memes for your enjoyment

Sister communities

- [email protected] : Star Trek memes, chat and shitposts

- [email protected] : Lemmy Shitposts, anything and everything goes.

- [email protected] : Linux themed memes

- [email protected] : for those who love comic stories.

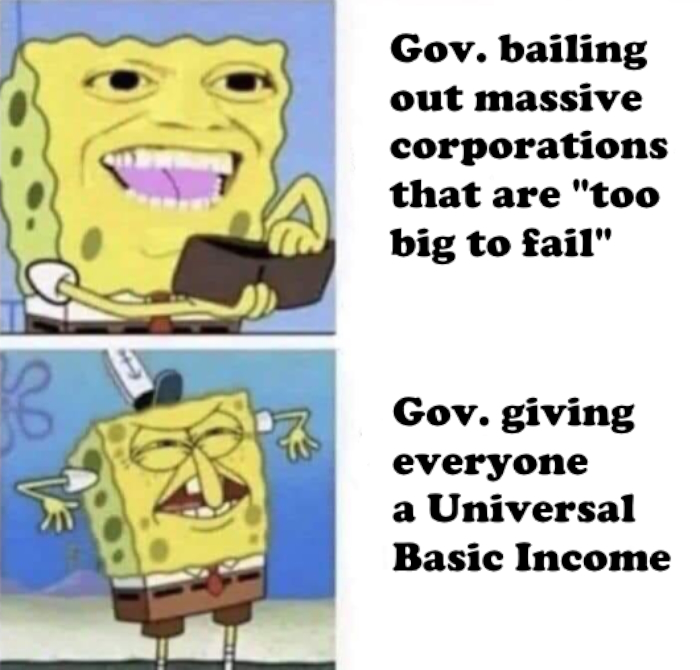

Although I like the concept, I just don't see a world where UBI does anything helpful. Unless people are able to just not work and all goods are human free/automated. Otherwise companies' products and housing will rise to meet what they now know you have in income. Give everyone $1k and prices will rise to consume that $1k so you just end up feeding tax dollars into companies mouths. Pay for it by taxing the companies and they will increase prices till they hit the sweet spot intersection of cost/value, but people will still be at a negative because some of that resource pool gets eaten by government management of the UBI system.

May as well do what we used to and tax companies more and put that into social services, at least companies can't squeeze that from us.

If governments had paid to cover mortgages instead of just hand outs to major corporations the GFC would not have been so bad.

How about we stop spending so much money. The US is already in $36 Trillion dollars of dept.

That debt means nothing on its own. Correctly managed debt is a great way to earn a lot of money.

Government debt is not the same as individual or corporate debt. Most of the US's debt comes in the form of issuing Treasury Bonds, and most of the debt is owed to the American people. The US also controls its own money supply in which that debt is denominated.

Also, spending is only part of why debt goes up. A huge portion of the US debt has been created through tax cuts, e.g. the $1.5 trillion Ryan-Trump tax cut for high earners early in Trump's presidency

Who cares if most of it is owned to rich Americans. If anything it is all worse because you are creating a totally non-thinking investment, an easy way for the rich to keep their money instead of them trying stuff like starting new ventures. Ever heard of the crowding out effect?

Yes the US controls its own money supply in very vague sense of the word "control". If the fed tried printing it's way out of debt inflation would cause collapse.

You really like the black and white arguments, don't you?

Controlling a source of money doesn't mean the only option is to print so much of it that inflation eats the whole economy.

Let me ask you this: if the US is so bad at managing the debt it owes to its people, how come we have functioned as an economy under that debt for the last several decades?