this post was submitted on 14 Jan 2024

666 points (98.3% liked)

People Twitter

4853 readers

2456 users here now

People tweeting stuff. We allow tweets from anyone.

RULES:

- Mark NSFW content.

- No doxxing people.

- Must be a tweet or similar

- No bullying.

- Be excellent to each other.

founded 1 year ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

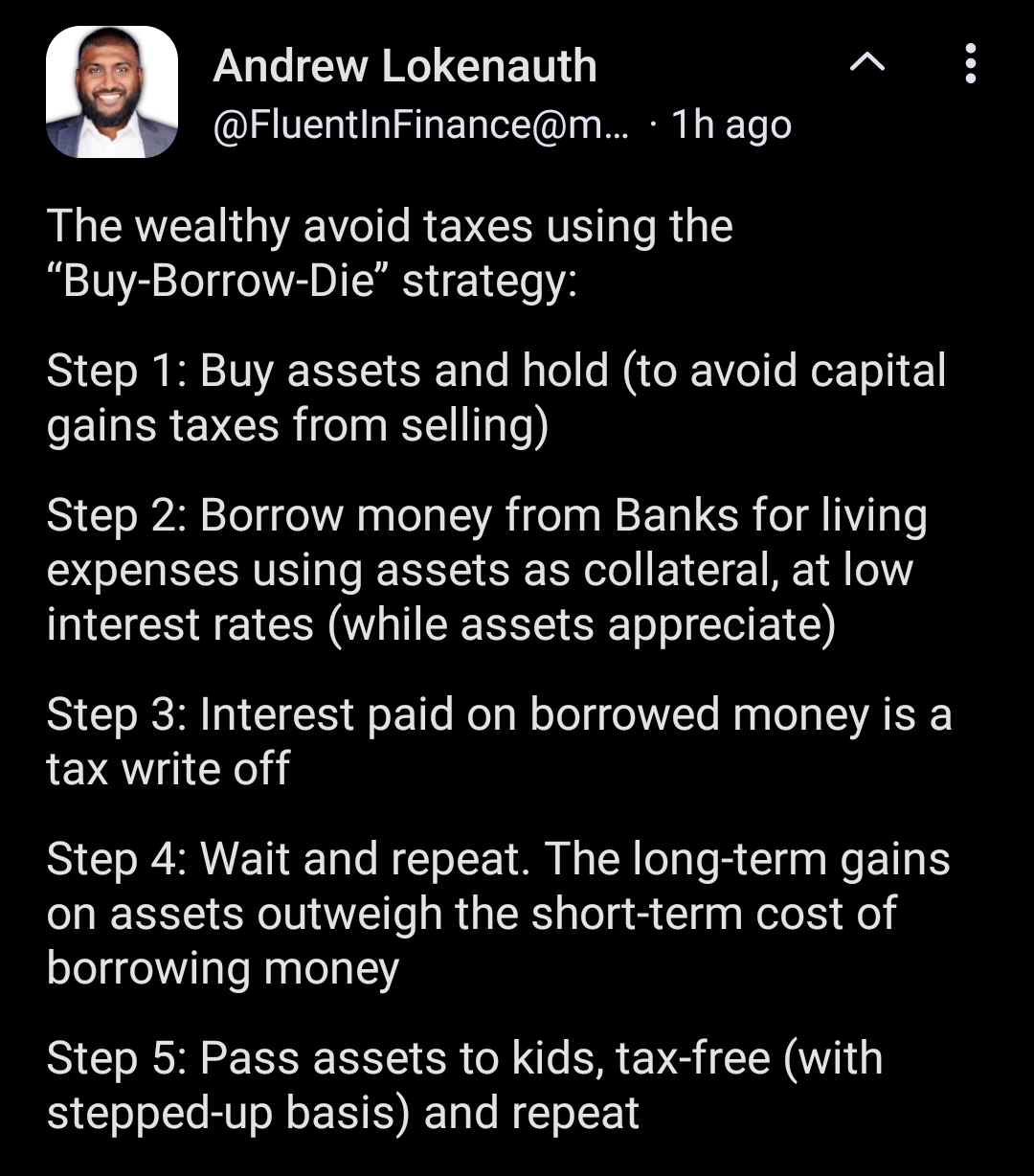

Where are you getting a loan for 3% while the stock market is performing at 7%? I always see these arguments, but borrowed interest is almost never lower than gains. That's why step 2 of any worthwhile financial plan is always "pay off your credit cards and high interest loans", right after "save enough for an emergency fund". "Invest your money" doesn't come until a few steps later.

Banks will happily take 3% risk free from someone sufficiently wealthy given the associated relationship benefits: a multi-millionaire or billionaire is probably going to hire that bank for wealth management and pay fees, etc, etc.

I'll have to take your word for it, I guess. It'll be a long time before I have a million dollars cash.

That's true for most folks, and is why it's so hard for people who aren't ultra wealthy to understand just how different the world is when you have that kind of wealth; a world where the law and the financial system and the basic experience of the economy is completely and utterly different due to the power and influence that wealth brings.

Heck, most people can't even truly grok the scale of the difference between an average person and a multi-millionaire or billionaire. The human brain just doesn't process large numbers like that well.

I'm far from rich, but I do have a paid off house in a low CoL area, and a have decent chunk of retirement savings put away, and even then I get different treatment: better credit cards, better loan products, etc. The industry calls it "qualifying" but what it really is is monetary gatekeeping.

It's particularly weird having grown up relatively poor because I've lived the shift and can see how expensive it was to be poor, and how relatively easy it is for the rich to get richer.

¯\_(ツ)_/¯ Presumably billionaires get offered exceptionally favorable terms that aren't available to the general public, I guess?