this post was submitted on 14 Jan 2024

666 points (98.3% liked)

People Twitter

4853 readers

2456 users here now

People tweeting stuff. We allow tweets from anyone.

RULES:

- Mark NSFW content.

- No doxxing people.

- Must be a tweet or similar

- No bullying.

- Be excellent to each other.

founded 1 year ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

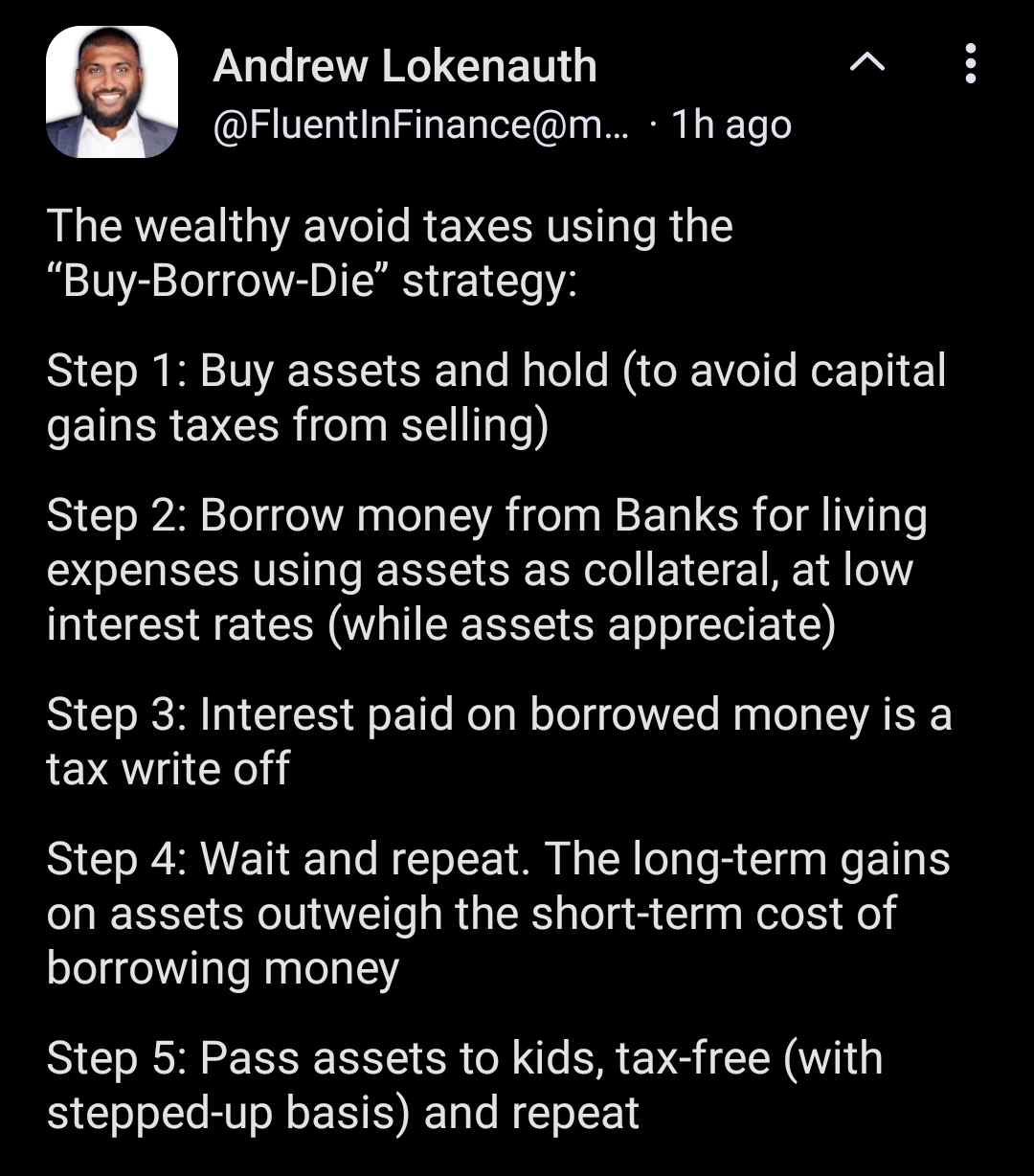

In the UK inheritance tax starts above 325,000 pounds, there's some exceptions that can increase that threshold to 500,000, but generally anything above 325,000 is taxed at 40%.

I know nothing of UK taxes, but are there methods of sidestepping those taxes with some planning?

There are ways to lessen the load, gifts can be given before death though you have to live on for seven years or tax is collected, trusts can be set up, if property is left to a spouse or direct descendent, then up to a certain value it's got a nil rate... but its not great