this post was submitted on 20 Jan 2025

321 points (94.2% liked)

memes

11033 readers

2374 users here now

Community rules

1. Be civil

No trolling, bigotry or other insulting / annoying behaviour

2. No politics

This is non-politics community. For political memes please go to [email protected]

3. No recent reposts

Check for reposts when posting a meme, you can only repost after 1 month

4. No bots

No bots without the express approval of the mods or the admins

5. No Spam/Ads

No advertisements or spam. This is an instance rule and the only way to live.

Sister communities

- [email protected] : Star Trek memes, chat and shitposts

- [email protected] : Lemmy Shitposts, anything and everything goes.

- [email protected] : Linux themed memes

- [email protected] : for those who love comic stories.

founded 2 years ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

Meanwhile in Sweden:

Tax office: "This is exactly how much you have earned last year, this is how much tax you paid, this is how much we expect you to owe, or how much we expect that we owe you, do wish to make any corrections? If not please sign with any of the following methods:

Remember that is you sign early you will get any taxes owed to you payed back earlier!

Have a good day!"

I would kill a man for taxes that simple. Holy fuck.

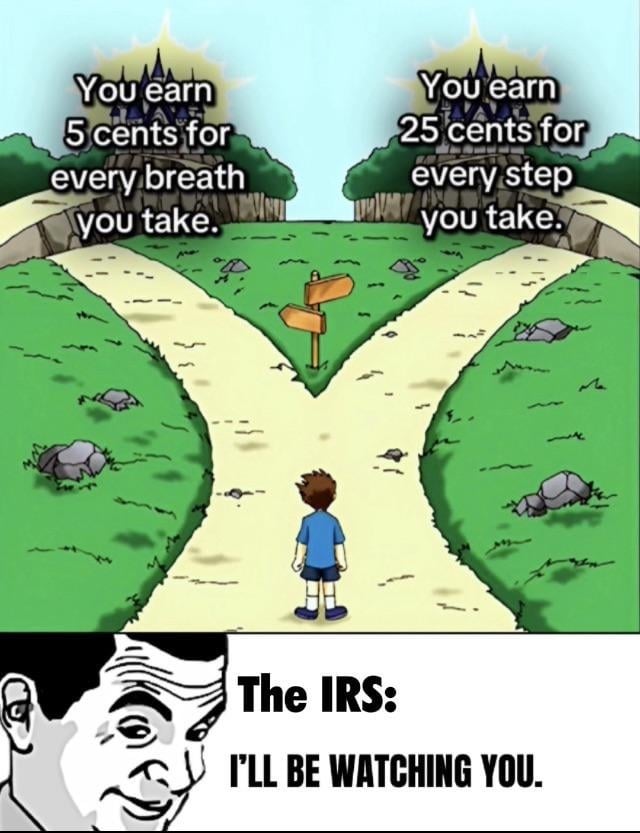

The IRS is a complete shitshow by design, and it’s largely because Intuit et al lobbies (read: bribes) politicians like crazy to keep tax code complicated, so that they can continue to have a business model.

Send more blue shells; we need ‘em.

Fun fact, it is not uncommon for people to file their taxes on the bus to work through their mobile phone.

Meanwhile in Norway:

"If you don't have any corrections literally do nothing and just ignore this lmao"

In the UK, unless you're self employed, you don't have to do anything at all.

You might just receive a letter saying HMRC either owes you money or you owe them money.

or have child benefit. If you earn over a certain amount, they ask you to refund that benefit through self assestment.

still tho, it's grand. I once paid too much tax and got back a cheque

I wish we had the same in Germany. Our tax office knows all the data already!

One thing that the Swedish government has realized is that if you want people to pay tax, make it as easy as possible, people hate paperwork, minimize that crap.

I pay more tax than I need to, just so I won't need to worry about back taxes, I just get a tax return instead, less paperwork and logistics.

I firmly believe that people don't hate paying taxes, they hate the related paperwork

i hate paying taxes

Do you like indoor plumbing?

it's literally my mortal enemy /s

Here in Brazil the government does the same. But it's often wrong...

It's still helpful, but well, I wish I didn't have to check every little detail.

You guys live in a utopia. Sounds so nice.

Two years ago I sold some stock I inherited, I had to call the tax office and ask how to deal with it, I got put in a queue, at place 600 something, 10-20 min later I was speaking with an agent who patiently verified my calculations and explained how I would need to actually report and pay my taxes, all of which was easy an straight forward, enter ammount A into box b17 on the second page, and enter ammount B into box b18, then transfer the ammount you owe to your tax account (transfer it to the tax office and use your national ID number as the reference), and sign your tax statement.

Excluding the call it took me a total of 15 min to verify all numbers and sign the statement.

A few month later I got a confirmation from the tax office that everything was done.