this post was submitted on 02 Dec 2024

981 points (98.6% liked)

memes

10629 readers

1947 users here now

Community rules

1. Be civil

No trolling, bigotry or other insulting / annoying behaviour

2. No politics

This is non-politics community. For political memes please go to [email protected]

3. No recent reposts

Check for reposts when posting a meme, you can only repost after 1 month

4. No bots

No bots without the express approval of the mods or the admins

5. No Spam/Ads

No advertisements or spam. This is an instance rule and the only way to live.

Sister communities

- [email protected] : Star Trek memes, chat and shitposts

- [email protected] : Lemmy Shitposts, anything and everything goes.

- [email protected] : Linux themed memes

- [email protected] : for those who love comic stories.

founded 2 years ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

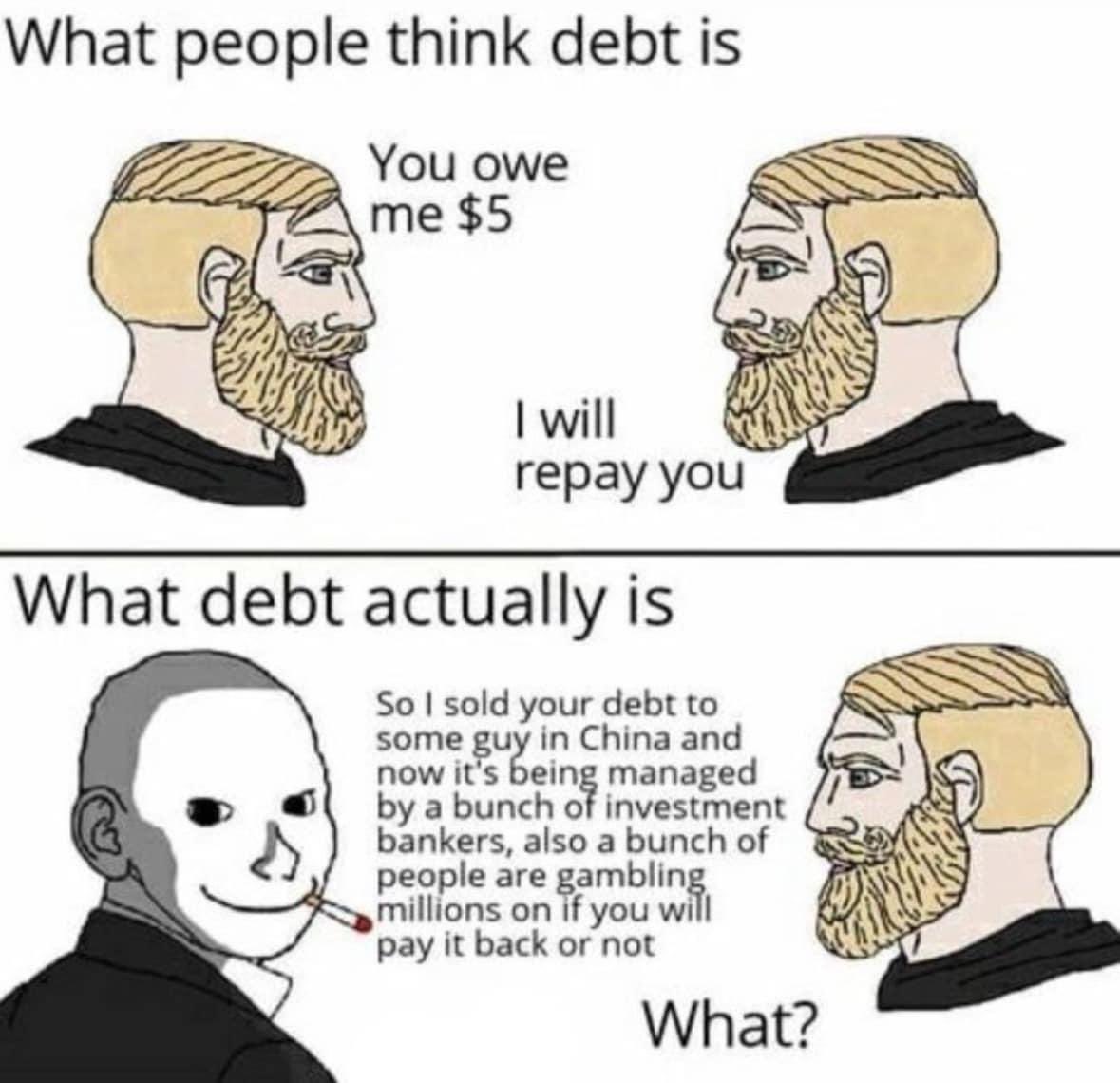

The 2008 crisis was an example of mass fraud, and I'd be happy to be proven wrong. You can't point to historical data saying your investment strategy is safe, even tho you completely changed the model. Saying "mortgages are safe" doesn't mean shit, if to compensate for demand you start handing out mortgages like candy.

I think calling it gambling is quite charitable. And ofc all the ~~scam artists~~ banks got bailed out.

The stock market in general is joke. There are so many stocks where it's an open secret they are fake. Like the Ruble, Tesla and most crypto currencies. The stock market is a world of make believe, where any random decision can change everything. It still fascinates me that the second trump won with his tarifs on EVERYTHING, the stock market grew. What's next? "Company CEO starts randomly shooting all his employees, stocks reach all time high!"

I guess it mostly depends on how you define fraud.

If i buy something from china, and on the way to the US it falls off the boat and into the sea, destroying it forever, is that fraud?

historical data has nothing to do with the safety of investment. That's like looking at the fatalities in a war, and deriving the danger from being inside of trenches.

The safety is defined as a component of risk, and stated responsibilities. An extremely safe asset would be something like land, it never moves, doesn't go anywhere, people will always want it for something. Though it's not an investment.

A safe investment would be something like a long term diversified stock portfolio, or government bonds.