this post was submitted on 02 Dec 2024

981 points (98.6% liked)

memes

10629 readers

1947 users here now

Community rules

1. Be civil

No trolling, bigotry or other insulting / annoying behaviour

2. No politics

This is non-politics community. For political memes please go to [email protected]

3. No recent reposts

Check for reposts when posting a meme, you can only repost after 1 month

4. No bots

No bots without the express approval of the mods or the admins

5. No Spam/Ads

No advertisements or spam. This is an instance rule and the only way to live.

Sister communities

- [email protected] : Star Trek memes, chat and shitposts

- [email protected] : Lemmy Shitposts, anything and everything goes.

- [email protected] : Linux themed memes

- [email protected] : for those who love comic stories.

founded 2 years ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

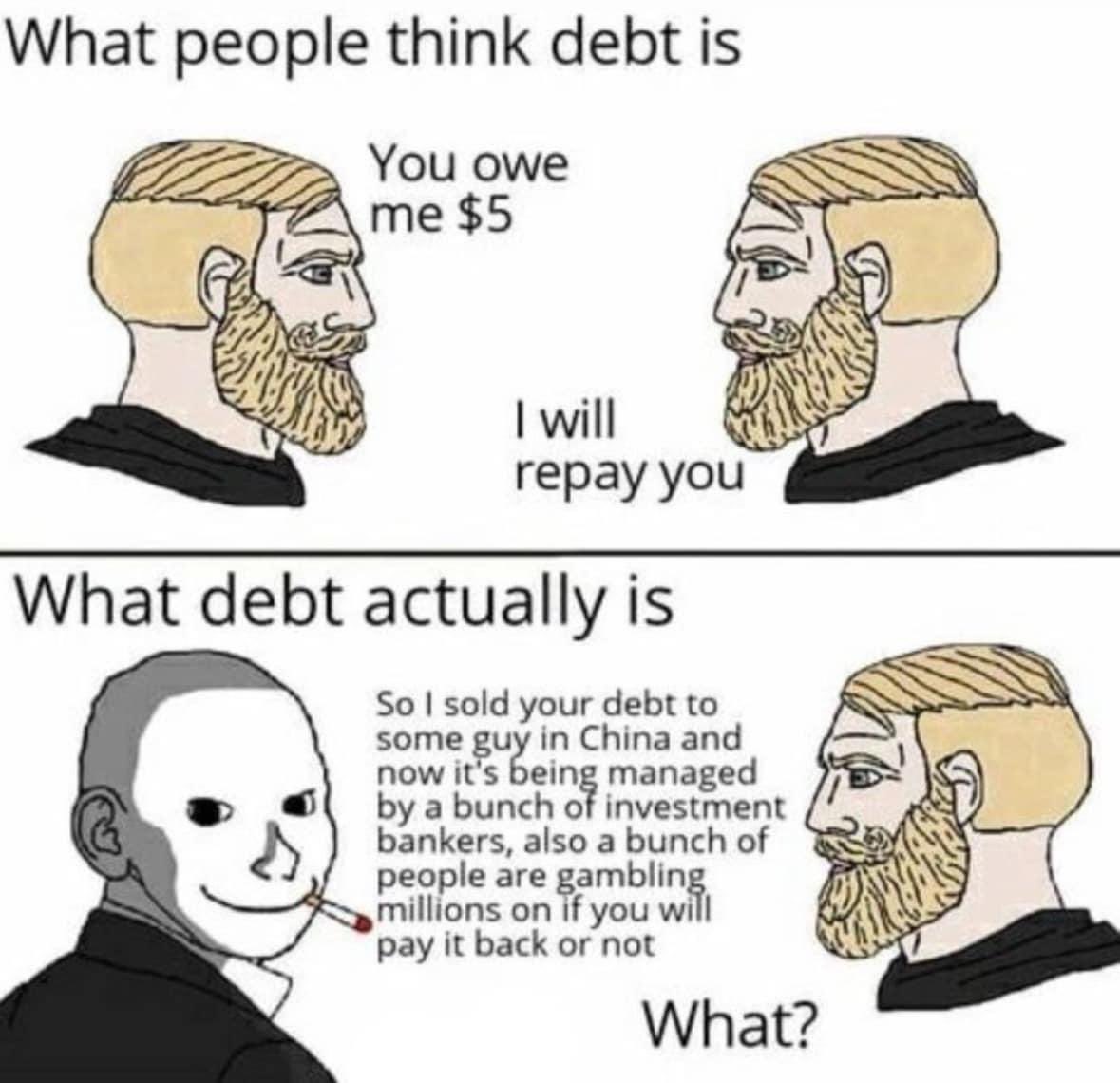

Risk management is at the core of both investment and gambling. The riskier your investment, the closer it comes to just putting the money on a roulette position in practice. There are plenty of portfolios that slowly hemorrhage money and/or eat up any would-be growth via fees: those are your 51-49 splits. Also it doesn't matter if there's such a split if you decide to go all in and it goes belly up, however you slice that.

If you do risky shit with money, it's a gamble whether it pays off. Maybe I'm misunderstanding the point you're trying to make?

i would fundamentally disagree, with gambling statistically on average, you always lose. It's not mathematically possible to win.

This is the reason that things like investment work at all.

It's complicated, but there are a lot of traders that aren't very good, and there are a lot of traders that are very good, if you just let the market do it's natural thing, it has a general tendency to go up. Especially long term, you cannot functionally do this with gambling, you ALWAYS lose.

I would argue that there are risky investments, and then safer investments, and there are really risky investments. None of these are gambling, gambling would be like i said investing most of your life savings, into a particular thing expecting a particular result, with the extreme risk of "losing everything" generally investments are never going to "lose everything" that's also why you have a broader portfolio.

I think gambling is just a fundamentally different philosophical concept.

I guess theoretically nothing stops you from literally gambling with stocks, but that would be incredibly stupid.

I think you have a very specific definition of gambling which I don't share. To me, gambling is much broader. Wikipedia summarizes it well:

"Gambling thus requires three elements to be present: consideration (an amount wagered), risk (chance), and a prize."

That's it. It doesn't make an opinion whether the bet is fair. There doesn't have to be a casino involved at all. It also doesn't require you to put "most or your life savings" into it for it to be gambling.

I think you are conflating high risk, high stakes and even the precence of a casino into the same concept and call it gambling.

https://en.wikipedia.org/wiki/Gambling

That definition encompasses everything we do in life. From crossing the road, to buying a fridge, to falling in love.

Exactly! Which is why it is mad trying to outlaw or frown upon "gambling" with stocks.

There are many great wxamples in this thread already of why derivatives are necessary to a functioning society.

You are gambling whenever you get in your car and drive. You are gambling if you get out of bed. You are gambling if you spend too much time in bed.

Risk being present isn't enough. I think the definition of gambling should include a willful decision to increase the level of risk.

The problem, like with many things in life, is that there's a desire for people to place clear delineations on things for purpose of clarity and peace of mind, when it actually exists on a very fuzzy spectrum. I'd argue you do gamble a tiny percent chance of getting in a wreck every time you drive in exchange for getting places much faster. Likewise, were you to walk instead, there are unique risks and payoffs associated with that choice too.

Whether or not the risks are well known or there's a decision to increase the level of risk is a little beside the point. There are plenty of people addicted to gambling who genuinely believe they'll hit it big and retire one day, and that the reward payout is inevitable even when it's clearly not.

Some derivatives aim to lower the risk, so the active decision to buy it would be to ungamble then? Or is it just gambling wyen you choose not to buy it?

Do you have insurance on your house or do you gamble that it will be fine without it?