this post was submitted on 02 Dec 2024

981 points (98.6% liked)

memes

10637 readers

2246 users here now

Community rules

1. Be civil

No trolling, bigotry or other insulting / annoying behaviour

2. No politics

This is non-politics community. For political memes please go to [email protected]

3. No recent reposts

Check for reposts when posting a meme, you can only repost after 1 month

4. No bots

No bots without the express approval of the mods or the admins

5. No Spam/Ads

No advertisements or spam. This is an instance rule and the only way to live.

Sister communities

- [email protected] : Star Trek memes, chat and shitposts

- [email protected] : Lemmy Shitposts, anything and everything goes.

- [email protected] : Linux themed memes

- [email protected] : for those who love comic stories.

founded 2 years ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

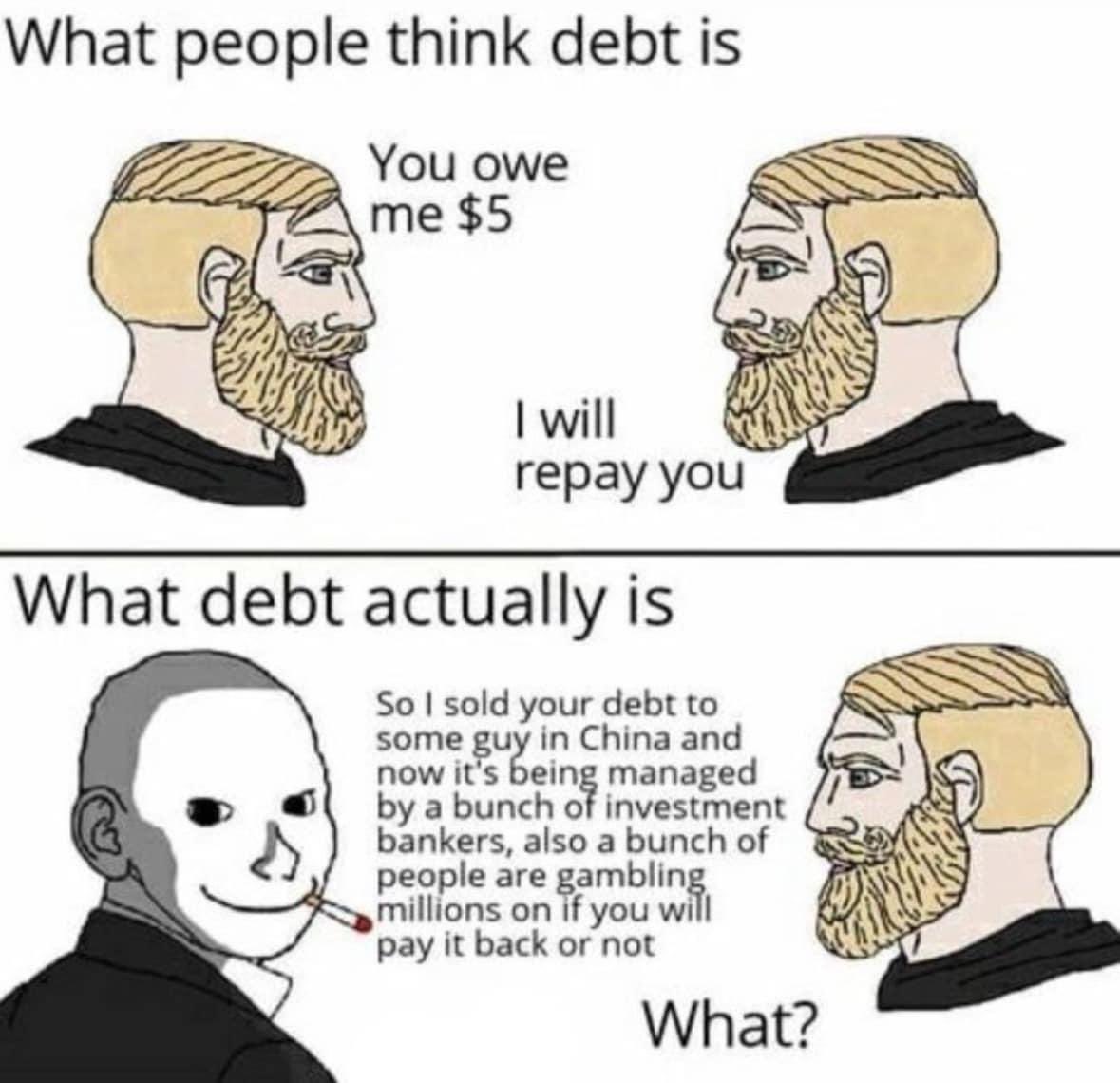

While funny, and this is a the meme community, God it's so much worse than that. Debt accumulated in a western style capitalist society is just how money exchanges hands. Your debt, the one that deeply affects your life, that can ruin your ability to make basic purchases and health care is a simple gamble for the rich, OUR debts.

Their debts are waved away, all because it makes more profits to forgive major mistakes when the other people are rich. I'm looking at you GM and Chrysler, I'll never forget.

Edit: I forgot.

Wasn't Ford the American auto company who didn't have to be bailed out by taxpayers while GM and Chysler did?

Maybe. Listen, what I said was in the moment. You can't blame me for being stupid on the internet lol.

You just need to be more careful.

I've never been wrong about anything online. How could that even happen?

Asymptotically Correct (Wrong in this instance)

well no, so there are technically two types of debt, personal debt, the kind of shit you have on your car or house. Which are generally negative, and then investment based debt, a debt that is presumed on the potential future evaluation of a company for example. This is inline with how a lot of VC funding is done, although more complex.

There's also the concept of having asset backed debt, for example a car, or a house. The downside here is that cars and houses are generally very important to daily life, but if your debt is based on the valuation of your company for example, that inherently holds significantly less personal risk to you.

There's also a much more complex macro economic theory, where if extremely large players go down, a significant portion of the economy also goes down. It might be beneficial for a government to absolve the debt of a national company if for example, it protects broadly from a significant economic retraction, similar to the kinds we've seen before like in the great depression. Granted in that case, we did nothing, and everything imploded, globally.