this post was submitted on 15 Sep 2024

1398 points (97.3% liked)

Microblog Memes

6645 readers

2092 users here now

A place to share screenshots of Microblog posts, whether from Mastodon, tumblr, ~~Twitter~~ X, KBin, Threads or elsewhere.

Created as an evolution of White People Twitter and other tweet-capture subreddits.

Rules:

- Please put at least one word relevant to the post in the post title.

- Be nice.

- No advertising, brand promotion or guerilla marketing.

- Posters are encouraged to link to the toot or tweet etc in the description of posts.

Related communities:

founded 2 years ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

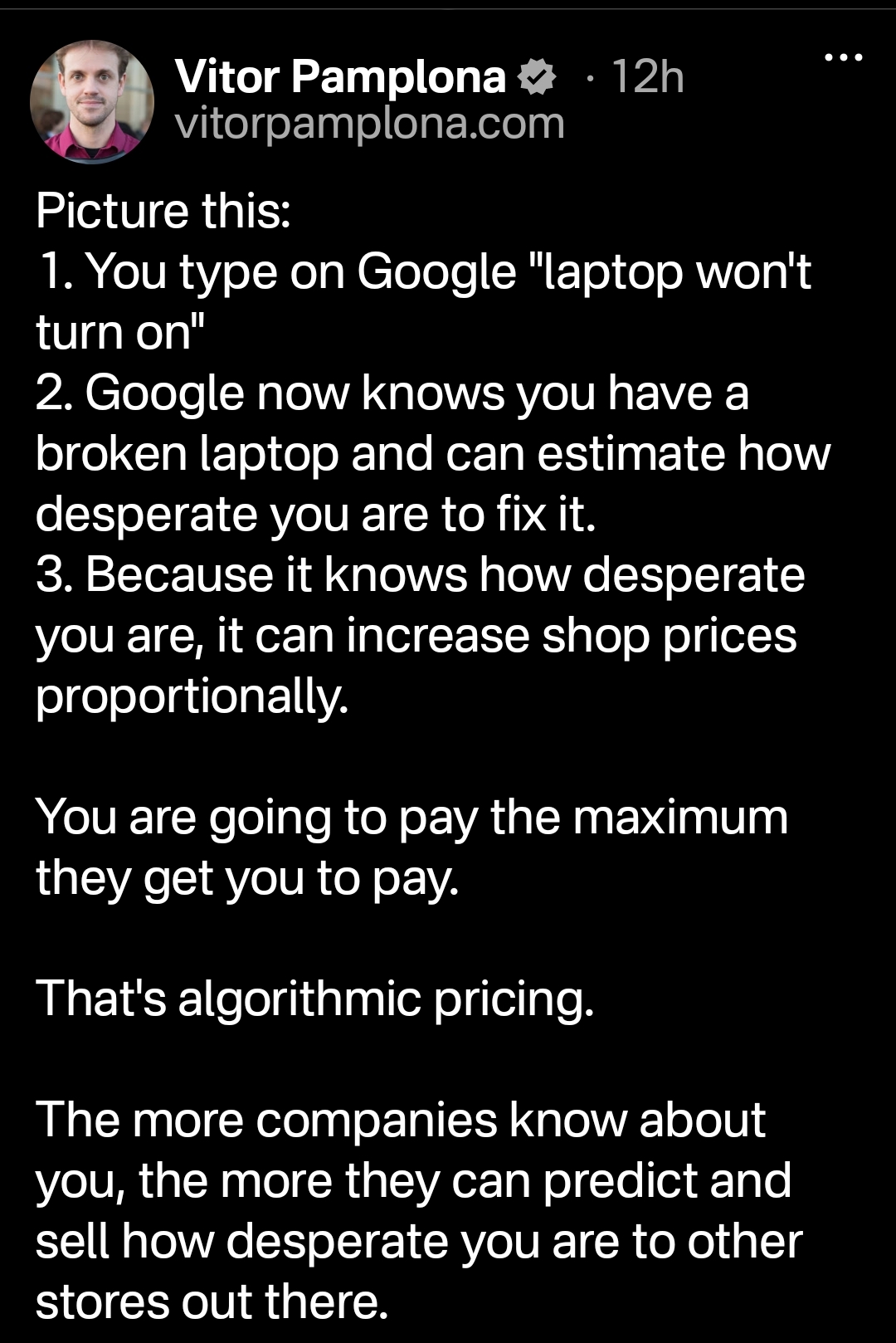

You don’t need a monopoly for this to be a problem.

Databrokers can offer data sets of “customer price elasticity”. Tables of “how much we think X would spend on these generic item categories”. Eg “booly would pay $15 for a burger, vs $10 average”

Point of Sale systems could start offering integrations to these data sets.

All shops have to do now is set a list price, a minimum price, a category, and leave it up to the PoS to (not) give discounts.

You want a burger, you’re fed a single-use short lived discount “$5 off a $20 burger. Today only” While someone else gets “buy one get one free”.

It’s then a ‘fair’ market. Shops have and ‘compete’ with their (high) list prices, data brokers compete with “excess profit” statistics (ie, how much more money above the minimum price they made). Nobody is colluding, they’re just basing discounts off external arbitrary signals.

It slowly becomes the norm to get just-in-time discounts, and the consumer gets shafted. If you’re not in the system, you’re paying more than everyone else.

(And all of this has been happening in some markets for over a decade)

This framework you describe is still grounded in a large number of producers intentionally avoiding undercutting the competition in price.

If a profit can be made selling burgers for $10, and literally every burger seller knows that I'm happy paying $15 for a burger, they still have to compete with each other to get my business. Am I going to choose the place that charges everyone $10, or the place that I know engages in opaque pricing and is offering me $15? The most sophisticated price discrimination algorithm in the world doesnt do any good if the other burger shops don't play along.

And this plays out every day in places like airports. Yes, I know I just need to eat before I jump on my connecting flight, and I'm not super price sensitive in that situation. But I won't go to the place that's far and away more expensive than another, or who I just recently read about on some travel blog as a price gouger.

And for a more concrete example of something that happens today, with services that are worth a completely different price than what it costs to provide it, and where everyone knows the buyer is valuing the service at that high value. Say I have an unfinished basement, and I want to hire a contractor to finish it with drywall, paint, flooring, HVAC, etc. It's obvious to everyone how much that project adds to the livable square footage, and plenty of public valuation models show exactly how much that job adds to the value of the home. And everyone knows I'm about to list the home afterward for sale. But if 10 contractors are competing for the job, they don't really care what value it provides to me if I choose not to hire them, so they're bidding prices that cover the level of profit they want to make on the job, while not ceding the price advantage to the competition. The presence of competition tempers the price gouging.

So I still think competition is the key policy to pursue. Competition solves the problem being described here, and any market with this kind of individualized price gouging is suffering from insufficient competition.