this post was submitted on 28 Apr 2024

1034 points (90.8% liked)

memes

9351 readers

2162 users here now

Community rules

1. Be civil

No trolling, bigotry or other insulting / annoying behaviour

2. No politics

This is non-politics community. For political memes please go to [email protected]

3. No recent reposts

Check for reposts when posting a meme, you can only repost after 1 month

4. No bots

No bots without the express approval of the mods or the admins

5. No Spam/Ads

No advertisements or spam. This is an instance rule and the only way to live.

Sister communities

- [email protected] : Star Trek memes, chat and shitposts

- [email protected] : Lemmy Shitposts, anything and everything goes.

- [email protected] : Linux themed memes

- [email protected] : for those who love comic stories.

founded 1 year ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

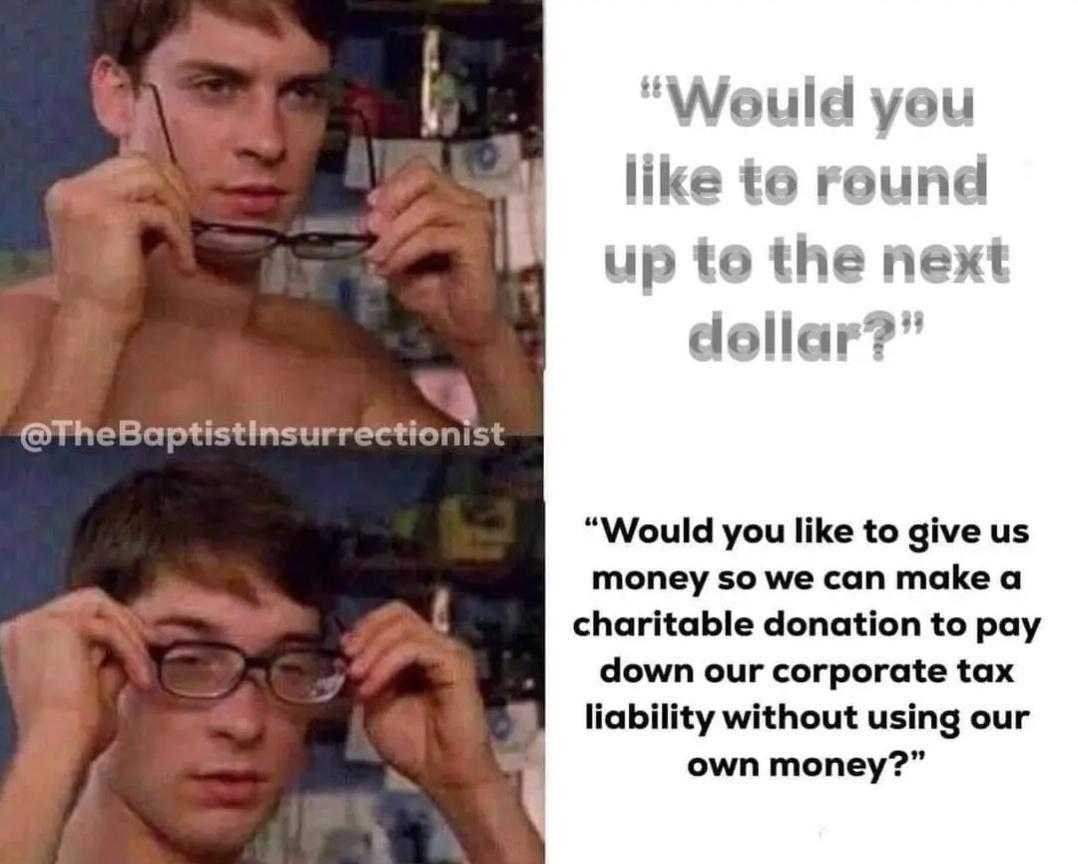

#2 and 3 don't actually happen since it can't be recorded on the P&L.

The donation would get recorded to cash and offset to a liability account, probably something named Charitable Donations Payable likely with a subaccount for the specific programs.

Overall, the effect is essentially the same, though. Fwiw, I like to use the same comparison as you did to show to people how dumb this belief is.

The individual who donated at the register also is allowed to claim the donation when they file their taxes.