this post was submitted on 03 Aug 2023

158 points (100.0% liked)

196

16442 readers

1855 users here now

Be sure to follow the rule before you head out.

Rule: You must post before you leave.

founded 1 year ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

A capital gains tax works well for the rich that have the majority of their wealth tied up in stocks.

Except billionaires take advantage of a loophole whereby they can take out loans using stock as collateral, instead of selling the stock, meaning they pay no capital gains.

https://www.propublica.org/article/the-secret-irs-files-trove-of-never-before-seen-records-reveal-how-the-wealthiest-avoid-income-tax

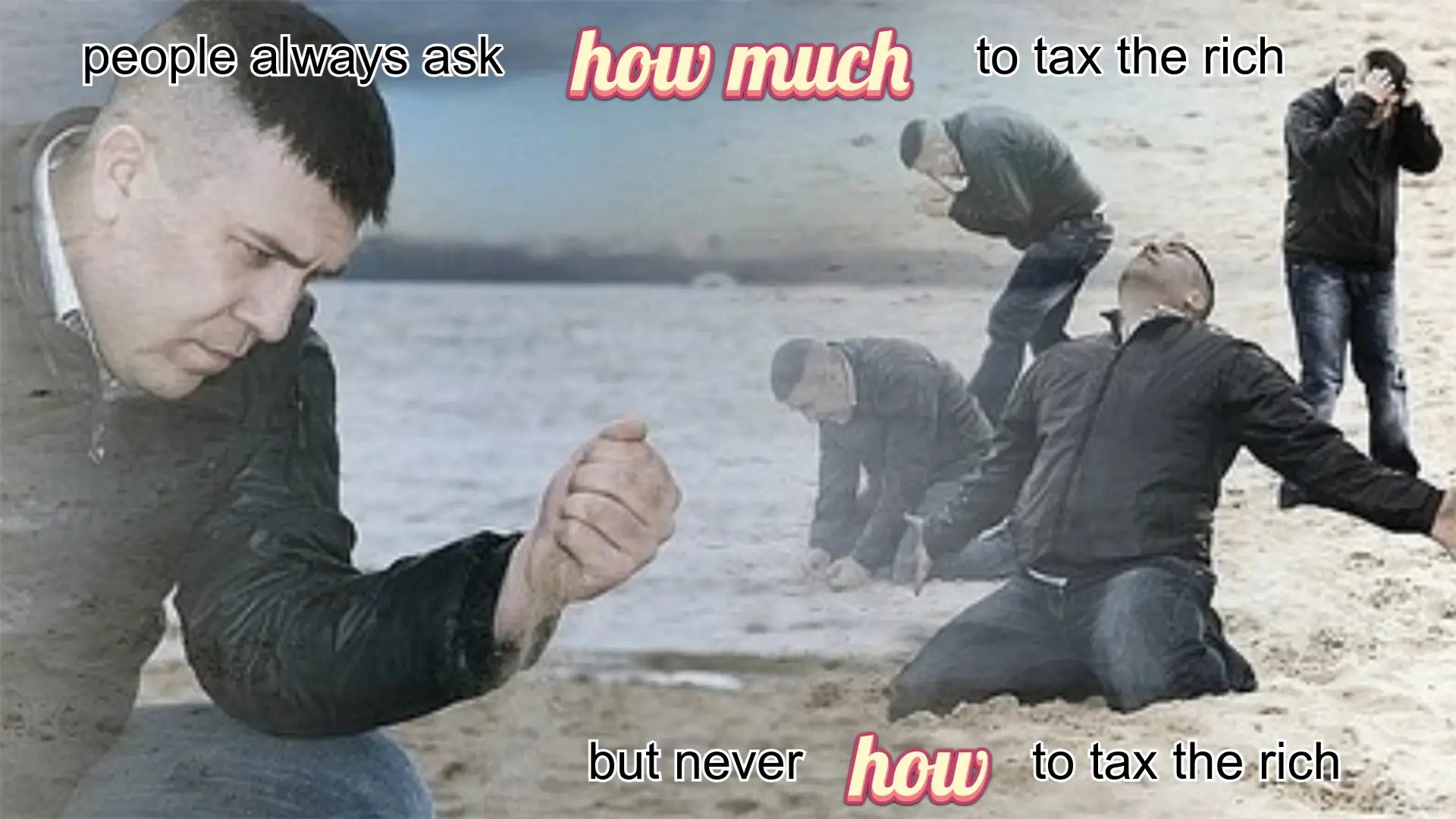

If we taxed land, it would be essentially impossible to evade, even with fancy accounting and shell companies and all that stuff the rich love to employ. All this is exactly why the how of taxing the rich is so important.

Yeah land value taxes are cool, but ultimately taxes are just a bandaid solution to rampant inequality. As long as billionaires keep their vast economic (and therefore political) power through control of the means of production, they have the power to undermine any attempt to tax their wealth away. Which is why we need a fundamental reorganization of the economy that places the power in the hands of the people. Otherwise known as socialism :)

Well, it's for that exact same reason the rich will oppose socialism. Personally, I'm more in favor of georgism, which is like socialism with regards to social control of the commons (most notably land and natural resources), but not regular capital. I think this is important because there is a meaningful distinction between land and capital and shouldn't just be lumped together under "the means of production". Capital is created, where land (and natural resources) are not, thus taking social control of land via taxes works fundamentally differently economically (and morally, imo) than taking social control of capital which has been created. For example, my uni degrees are a form of capital, and a system in which society takes control of the economic returns on my education is a system which disincentives people from pursuing higher education. But if society imposes a tax on me for the land I occupy or the carbon I emit, that's completely fair imo. Plus, the key policies georgism is based on (most notably land value taxes and externality taxes) are just really good policies as shown by economics. Even Friedman begrudgingly called land value taxes the least bad tax, as they're progressive, economically efficient, and incentivize productivity and discourage rent-seeking.