Maybe it is time to go back to the old ways. Go to an atm machine and cash it out.

Philippines

Mabuhay at maligayang pag-alis sa Lemmy! ✈️

An abandoned community for the Philippines and all things Filipino! 🇵🇭

Started out as a Reddit alternative during the blackout from Jun 12-21, 2023 with over 1k members in just a few days. Fizzled faster than the "I Didn't Do It" kid after a month until it became the internet's Centralia in less than a year.

Filipino artists whose works were featured on our daily random thread covers.

Banks should implement QRPH transactions on merchants. Exclusive to e-wallets lang kasi yung pagbayad through QRPH.

Agreed, very few merchants nagooffer ng BPI QR at BDOpay option.

BDOPay and BPI Vybe are e-wallet services. Magiinvalid yan kapag ini-scan mo sila with your bank's app.

Recently tried paying a merchant na may BDOPay, di tinatanggap ng bank ko. Yes, naka QRPH.

NOTE: Since July 1, naka-QRPH compliant na ang mga bank at e-wallet.

On a related note, I wish they would start implementing Samsung Pay, Google Pay, and Apple Pay locally soon. Hindi nama-maximize use ng smartwatch if pang-track lang ng exercise.

Yup, I think they started doing this a few months ago. UB is another one.

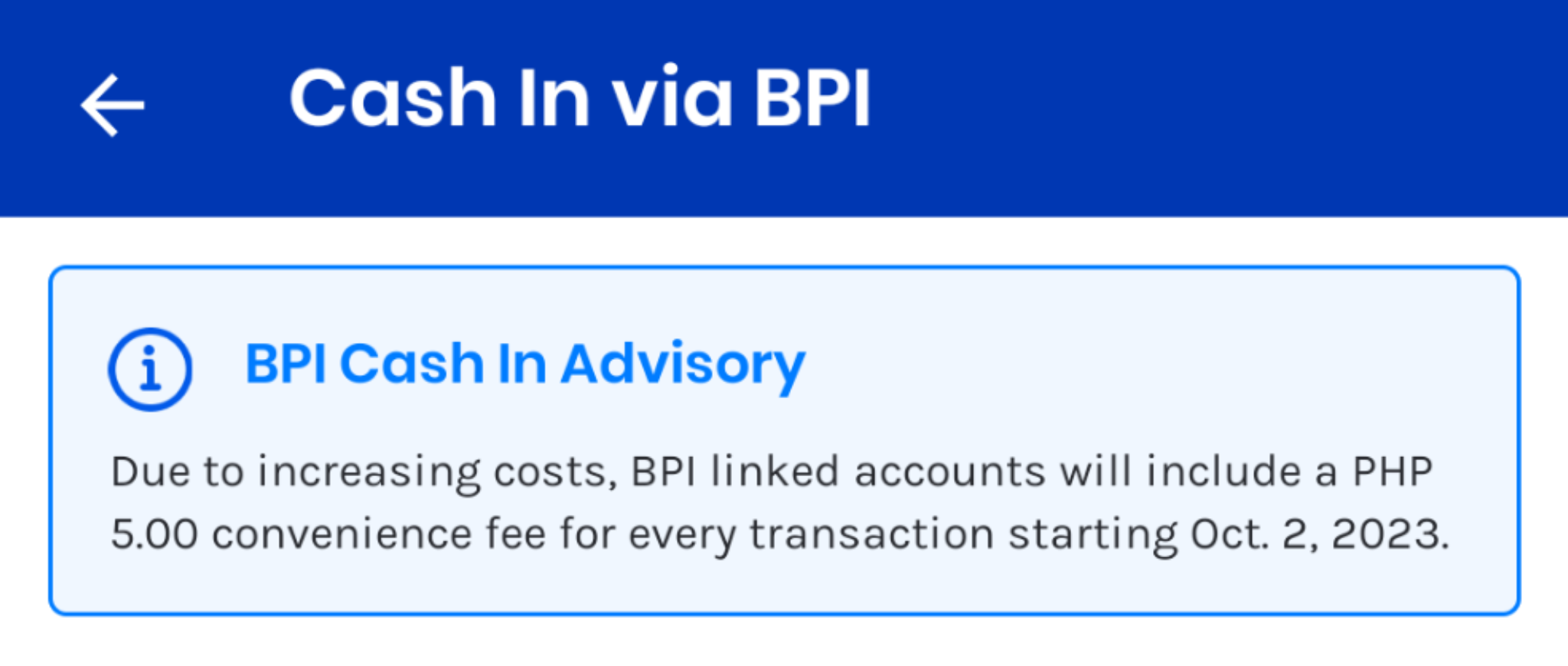

Big pain in the ass lalo na pag sakto lang plan ko ilipat, need pa magiwan ng butal to cover fees.

To be fair this is lower than other bank 25p. Though I have a feeling they will gradually increase this until it reaches 25p.

I don't know if it's fair. Yung bank to bank transfer fees sa instapay at pesonet, sinusulit ko by transfering the upper limit. Kung di pa abot ng upper limit, di ko muna ililipat. Dun ko nilipat sa digital banks na walang transfer fee to other banks or ewallet.

Yung GCash kasi usually for smaller payments so kung itototal mo yung charge for paying a total of PhP25K sa GCash, baka lugi ka dahil mas malaki pa sa Instapay. Kasi kung magbabayad ka ng bigger amounts, why not use credit cards di ba? Pwede mo icontest at wag bayaran yung credit card bill.

Yung GCash maraming gumagamit na walang access sa credit cards or banks services, in short mahihirap. I don't know if it's fair to ask them to eventually pay more because they don't have access to better financial institutions and services.

Yeah good point did not realize that. I guess they could have done is apply the fee when a certain limit is reached like what you mentioned about instapay. Other is government could also subside the fee for those low amount. I think gcash wants to increase their cash in limit but they can't because that's what make them competitive but on the other hand cash transfers between services are usually expensive because there is server cost, personnel salaries and more. So by setting it to 5 they would inheritly make a limit on the number of amount of money per transfer at the same time while still advertising that they have no limit. Just a disclaimer I don't work for gcash lmao all just speculation. Anyway it does sound scummy but they are currently leading e-wallet in the Philippines so they can get away with this. So what can we do? We could start paying cash again or use Maya, Coin PH or other e-wallets or traditional bank transfer.

Yep - just use Maya at this point since it's getting ridiculous

Soon, these banks and e-wallets will charge transaction fees when digital and cashless transactions become norm. It's inevitable.